- Andrzej Krajewski

A century and a half ago, the mighty Chinese empire fell to its knees before the "barbarians" from faraway Europe, in part because of the arrogance and hubris of successive Chinese emperors. The Europeans drained the Middle Kingdom of its vast resources for decades, and China entered "a century of humiliation" from which it is only now recovering.

After 150 years, however, the roles are reversed. It is China that stands at the gates of the Old Continent,

and the European Green Deal has given it the chance to open them with a powerful kick. The Europeans have created their own green game, but it is the Chinese who are winning. How are they doing it?

--

"China produces 80 percent of the world's solar panels - compared with 2 percent in the United States - and makes about two-thirds of the world's electric vehicles, wind turbines and lithium-ion batteries." - writes Christian Shepherd in an article published in the Washington Post on March 29, 2024. The journalist also quoted the founder of Tongwei Solar, which has transformed itself in a decade from an animal feed manufacturer to the world's largest producer of photovoltaic cells. Chairman Liu Hanyuan told the reporter that with companies like the one he runs, the Middle Kingdom: "will undoubtedly be a leading force in the global energy transition."

With Tongwei Solar announcing that it will produce photovoltaic cells with a total capacity of 130 gigawatts by the end of 2024 - four times the capacity of all solar power plants operating in the US - his thesis sounds very likely. Liu Hanyuan's company, and many others like it, would not have been so successful without government support. The former manufacturer of fish food and other products was able to transform itself into a high-tech company thanks to tax breaks and subsidies from the authorities. At the same time, it had to transfer some of its shares to two state-owned companies. In return, it received more than $125 million in support last year alone.

There are many more examples of Chinese companies like Tongwei Solar, as Beijing has committed more than $130 billion to support the solar sector through 2023.

Not surprisingly, U.S. Treasury Secretary Janet L. Yellen has begun to express Washington's increasingly tough stance on the issue. At a press conference held during the Secretary's visit to Suniva photovoltaic panel factory in Norcross, Georgia, she accused the Chinese government of deliberately blocking the development of solar energy industries in other countries. She added that the same was true for electric vehicle and lithium-ion battery manufacturers. According to Janet L. Yellen: "China’s overcapacity distorts global prices and production patterns and hurts American firms and workers, as well as firms and workers around the world”. She then added that: "It is important to the president and me that American firms and workers can compete on a level playing field". Two weeks later, Yellen, commenting on Beijing's policies, added: “China is now simply too large for the rest of the world to absorb this enormous capacity.”

However, Beijing doesn't seem to care about Washington's warning growls, which herald a further escalation of the trade war that has been going on between the United States and China since 2018. Earlier in March, during a meeting of the Politburo of the Communist Party of China, President Xi Jinping, according to China Daily, urged support for industries related to new energy technologies as they modernize the country's economy and, he added, "promote the development of new manufacturing forces." The CCP Politburo then stressed its pride in how competitive Chinese manufacturers of wind turbines and photovoltaic panels are proving to be. After which: "Xi noted that with a solid foundation in developing new energy sources, China has become a key driver of the global energy transition and the fight against climate change," the China Daily reported on March 2.

In contrast, the UK's Financial Times in late March analyzed how Beijing, despite the threat of further deterioration in relations with the US, is pushing through a policy of supporting mass production of everything related to the energy transition, pointing to several reasons. China's economic growth has slowed during the pandemic, while the specter of a crash hangs over the real estate market. At the same time, 1.4 billion citizens are holding their savings and cutting back on spending, fearing worse times ahead. This is dampening domestic demand and further slowing growth. At the same time, foreign investment inflows into the Middle Kingdom have fallen sharply.

In this area, China recorded its worst performance in 30 years. In 2023, only $33 billion in direct investment flowed into China, down 82 percent from the previous year. The last time such negligible sums were invested in the Middle Kingdom by foreign investors was in 1993.

https://twitter.com/MKalwasinski/status/1759315518471995731/photo/1

The fact that foreign capital, with a few exceptions (more on that at the end), has begun to bypass China by a wide margin is extinguishing another engine that has driven the growth so strongly. To top it off, the People's Bank of China has begun to sound the alarm that the country is threatened by deflation, one of the greatest enemies of economic growth. The confluence of all these factors is forcing a rush to save the Middle Kingdom from a looming recession.

The Financial Times, quoting analyst He Shujing of the research platform Plenum China, claims that: "China's top leaders believe the country needs to enter a new stage of structural transformation."

What does it mean? First, it means betting on the intensive development of new industries related to the energy transition that the world's most developed countries are planning.

The problem is that for its photovoltaic panels, wind turbines, electric cars, or batteries, China needs to find permanent, very large markets while eliminating competition from them. Meanwhile, the United States has already put up stiff resistance and begun to bite back. Not coincidentally, Janet L. Yellen made a trip to Norcross, Georgia. Suniva, which makes photovoltaic panels, was forced into bankruptcy by Chinese competition. But it was put back on its feet by money offered by the federal government to companies developing new technologies under the Inflation Reduction Act, passed in August 2022. It offers $369 billion in grants, loans and tax credits to support the development of renewable energy and low-carbon technologies in the US. This, along with tariff barriers, could effectively stop the flow of Chinese high-tech industrial products into the US.

Meanwhile, the success of Xi Jinping's economic strategy depends on the success of overseas expansion. For example, in 2023, China's photovoltaic panel companies will produce a total of 1,000 GW, with domestic market demand of - 280-320 GW. This means that two-thirds of production must be exported. Otherwise, the whole industry is facing bankruptcy. And since the US market is rapidly closing and the rest of the world, with the exception of the Arab countries, does not suffer from a surplus of financial resources, one direction of expansion is obvious. If Beijing wants to maintain economic growth, it must economically conquer Europe.

Opening the gateway to China

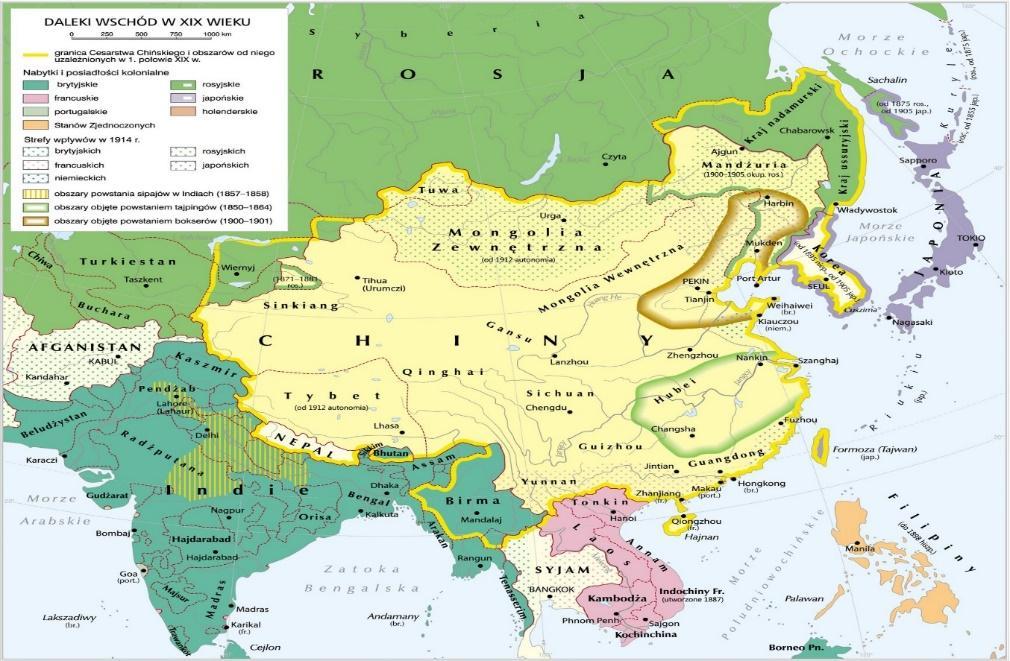

If there were to be an economic domination of the Old Continent by the Middle Kingdom, it would be a historical irony. Considering that about two hundred years ago, the exact opposite process began and it was Europe that set out to conquer China. Specifically, Great Britain opened the gates to its internal market with a strong kick, and other European powers followed suit. What happened next surprised even the initiators of the expansion, as no one expected such a spectacular success and its far-reaching consequences.

At the beginning of the nineteenth century, China covered an area of about 10 million square kilometers, roughly the size of all of Europe, but was inhabited by more than 400 million people. At that time, the Old Continent was half of that, while economically it gave the impression of being a poor province compared to China. According to Angus Maddison, a British economist and historian specializing in economic issues, Chinese agriculture and handicrafts produced as much as 29 percent of the world's GDP at the time. For this reason, the largest publicly traded company in the Western world, the British East India Company, which wanted to establish trade relations with the Middle Kingdom, initially referred to its rulers with the respect they deserved.

In 1793, in agreement with the British government, the Company sent an elaborate envoy to Beijing, led by Lord George Macartney. More than a hundred Englishmen - artists, politicians, merchants - presented the imperial court with the best of English culture and business. Lord Macartney offered a reduction in British tariffs and a political alliance in exchange for the opening of trade with Britain. Emperor Qianlong rebuffed these efforts with a scornful reply: "There is nothing we do not possess." He rejected all offers of cooperation, completely overlooking how dangerous the British, accustomed to conquest, were. He also overestimated the foundations of Chinese power.

Founded by Manchu invaders, the Qing dynasty ruled the Middle Kingdom for a second century, but it did not enjoy the sympathy of the native Chinese. Nor did the Manchu nobility, who held most of the privileged positions. China was divided by nationality disputes and huge economic disparities between the rich port cities and the very poor villages in the interior of the country. The 40,000 mandarins who administered the state on behalf of the emperor did not inspire much love among the subjects. They commanded an army of more than a million officials and collected fees and taxes on all economic activities. Such close control of the state provoked resistance. When an economic crisis loomed, peasants in the provinces immediately revolted. Local uprisings were bloodily suppressed, but new ones would soon break out.

Jonathan Fenby, in his book "Modern China: The Fall and Rise of a Great Power,”, cites a report sent to London by Lord Macartney. In it, the head of the ministry informed the British government that "The Chinese Empire is like an old, mad warship. Over the past one hundred and fifty years, successive gifted and vigilant dignitaries have happily managed to keep it afloat, intimidating its neighbors by its sheer size and the very fact of its existence. But if one day the wrong man is at the helm, woe betide the order on board, woe betide the safety of the ship.” Lord's observations were confirmed in the not-too-distant future. After a period of catastrophic disasters, a rebellion broke out in China, and in 1813 rebellious peasants nearly captured Beijing. Although the rebellion was eventually put down, the British immediately took advantage of the weakening of imperial power by establishing opium exports from India to China through the port of Guangzhou. They used it to pay for all goods delivered by Chinese merchants. The merchants were eager to do business with them because of the drug's popularity among the common people. The brokering and distribution of trade brought great profits.

In the hands of the British, opium proved to be a deadly economic weapon. They obtained valuable handicrafts, porcelain, silk, tea, etc. (almost all of China's exports) for a pittance. At the same time, they corrupted the state administration, permanently tying it to British interests. Using these tools, millions of consumers were made dependent on a regular supply of the drug, guaranteeing a stable market constantly hungry for new supplies.

Emperor Daoguang ignored the growing threat for 19 years of his reign. It was only a huge foreign trade deficit and the disappearance of silver coins, which affected the entire Chinese economy, that forced him to act. When there was a shortage of barter goods, Chinese merchants paid for opium with coins. Thus, stocks of precious metals flowed out of the Middle Kingdom and into Britain. It was a steady process of outflowing Chinese resources that had accumulated over centuries. At the same time, the East India Company intensified the cultivation of the poppy needed for opium production and processing throughout India, obtaining the drug almost for free.

So the process of sucking the wealth out of a huge country that was building the power of Great Britain on the other side of the world was underway. Emperor Daoguang did not try to stop this process until March 1839. On his orders, special commissioner Lin Zexu and a detachment of soldiers entered the British trading factories in Guangzhou. The commissioner confiscated 16 tons of the drug and 43,000 pipes for smoking it. He ordered them to be drowned at sea. He also began to arrest those responsible for plundering his country.

But London was not about to let go of its precious prize. Rear Admiral George Elliot's armada of twenty warships appeared off the coast of China in early 1840 and began sinking merchant ships one by one. The expeditionary corps of 4,000 soldiers then easily occupied Guangzhou. The Imperial Army counterattacked, but despite its overwhelming numerical superiority, suffered defeat after defeat. Suddenly, it seemed that the armed forces of a country with a population of nearly half a billion people were unable to defeat a tiny enemy force. Fearing total embarrassment, the emperor agreed to negotiations. These led to the signing of the Treaty of Nanjing in 1842.

Daoguang granted the British ownership of Hong Kong and opened the ports of Guangzhou, Fuzhou, Ningbo, and Shanghai to free trade. Beijing also lifted a ban on the sale of opium, exempted British citizens from local jurisdiction, and even agreed to pay huge compensation for Lin Zexu's drowned crates of the drug. This was the British kick that opened the floodgates to the Chinese market. The fact that it succeeded meant an imminent expansion of power from the Old Continent, with disastrous consequences for the Middle Kingdom. Meanwhile, as Jonathan Fenby has described: "Although it was a bitter and humiliating experience, the Chinese emperor did not seem particularly troubled. He revealed to one of the mandarins that foreigners were 'not worthy of his attention'.

A much more important problem for the monarch seemed to be the retention of the throne. Even if it was at the cost of exposing the country to gradual economic colonization.

Meanwhile, soon after the British success, an envoy from Washington appeared, not coincidentally accompanied by a squadron of warships. He demanded privileges for the United States similar to those that Great Britain had received. The threat of force was enough, and a deal was struck at Wanghia in July 1844, giving the Americans what they wanted.

https://chiny24.com/historia/chiny-polkolonia-europy-druga-wojna-opiumowa-i-ruch-samoumocnienia

This fact did not escape the attention of France and Russia. Soon these countries were in a kind of race to snatch more ports from China, turn them into trading colonies, and then continue their economic expansion inland.

Meanwhile, the Chinese offered little resistance. The next emperor, Xianfeng, proved to be an even more incompetent ruler than his father, Daoguang. It was obvious in 1856 when imperial officials seized the smuggling ship Arrow. Unfortunately, it was registered in Hong Kong as a British ship. The British mission demanded the return of the ship and compensation for damages. Upon hearing the news, riots broke out in Guangzhou. The Chinese, fed up with the Europeans, began setting fire to their homes. The riot was put down by British soldiers. In response, Prime Minister Henry Palmerston ordered reprisals. To nip Emperor Xianfeng's resistance in the bud. This was done in cooperation with France, which was also interested in extracting economic profits from the Middle Kingdom. The Second Opium War ended four years later when the Royal Navy sent an Anglo-French expeditionary corps to the area around the city of Tianjin. After capturing the fortress there, they moved on Beijing in September 1860.

The frightened emperor evacuated to Manchuria. The only resistance he received was an order to kill thirty Europeans who had been accidentally captured in the Chinese capital. After taking Beijing, the British burned the imperial summer palace in retaliation. "These palaces were really huge, and we were in such a hurry that we couldn't even search them thoroughly," later general and legendary defender of Khartoum Charles Gordon told his mother.

Only sixty years earlier, China had been the richest country in the world. After clashing with the fierce and flexible states of Europe, its internal weaknesses reduced it to the role of a colonized vassal. Step by step, it returned to the Europeans what it had the most precious. After winning the Second Opium War, Britain and France divided Shanghai between themselves. The British also took custody of the Yangtze estuary and the 1,800-kilometer Grand Canal, which connects the five great rivers to Beijing. They also annexed the lion's share of the revenue from the tea and silk trade. When Empress Cixi took the throne in exchange for giving up her resistance, the British and French helped her fight the Taiping Rebellion. The rebels were defeated in 1864, and after that London squeezed every possible profit out of a country that had fallen into utter stagnation.

How one-sided this cooperation was is best illustrated by the fact that China became so weak that even Japan, despised in Beijing, set out to conquer it in the late 19th century. Its army crushed the troops of Empress Cixi in a blitzkrieg and a peace treaty was singed in April 1895. The Middle Kingdom had to cede sovereignty over Korea, Taiwan, and part of Manchuria to Japan.

Other Chinese lands in the north were also appropriated by Russia.

https://www.geopoliticalmonitor.com/was-china-betting-on-russian-defeat-all-along/

After the Sino-Japanese War, St. Petersburg forced the surrender of Port Arthur and its adjoining lands as a form of repayment for a loan Moscow had offered to Beijing during its conflict with the Japanese.

Germany, meanwhile, annexed Shandong Province. A Bavarian-style German settlement with a central brewery was established in the port of Qingdao. There was even talk of educating the local population as "Chinese Germans" and incorporating the area into the Second Reich over time.

https://zpe.gov.pl/a/europa-u-szczytu-potegi-podboje-kolonialne/DOBv3HOH0

The invasion of China by all the world's major powers eventually led to an uprising called the Boxer Rebellion. It was sparked by the founders of the Society of Righteous and Harmonious Fists, which originated from ancient martial arts schools. Along with hundreds of thousands of Chinese, even Empress Cixi joined the uprising. Ignoring the gulf that separated China from the modern world on the military front, she declared war on eight major powers on June 21, 1900. Britain, Germany, Russia, Japan, the United States, France, Italy, and even Austria-Hungary - China has declared war on all of them.

Meanwhile, the imperial army was unable to capture even the parliamentary district of Beijing, where about a thousand foreigners were desperately defending themselves. Two months later, a 22,000-strong international expeditionary corps arrived in the Middle Kingdom and quickly crushed all resistance. The Europeans triumphed. In an effort to teach the Chinese respect, they destroyed Beijing's Summer Palace and the magnificent Hanlin Library, which contained priceless manuscripts. Empress Cixi fled the capital disguised as a peasant. But the British had no intention of overthrowing the ruling dynasty. Soon Cixi returned to the throne and had to swallow a new dose of humiliation. The victors imposed a contribution of 67 million pounds on China to share the profits. In addition, a 20,000-strong international garrison was permanently stationed in Beijing.

And so, a little more than a century after Lord George Macartney's envoy visited Beijing, China finally lost its sovereignty and became a semi-colony overseen by European powers. As luck would have it, before the Europeans could finally carve up the Middle Kingdom in partnership with the Japanese, World War I broke out in Europe, giving China the hope of regaining everything it had lost.

Za: https://glimpsesofhistory.com/european-imperialism-chinese-revolution-preface/

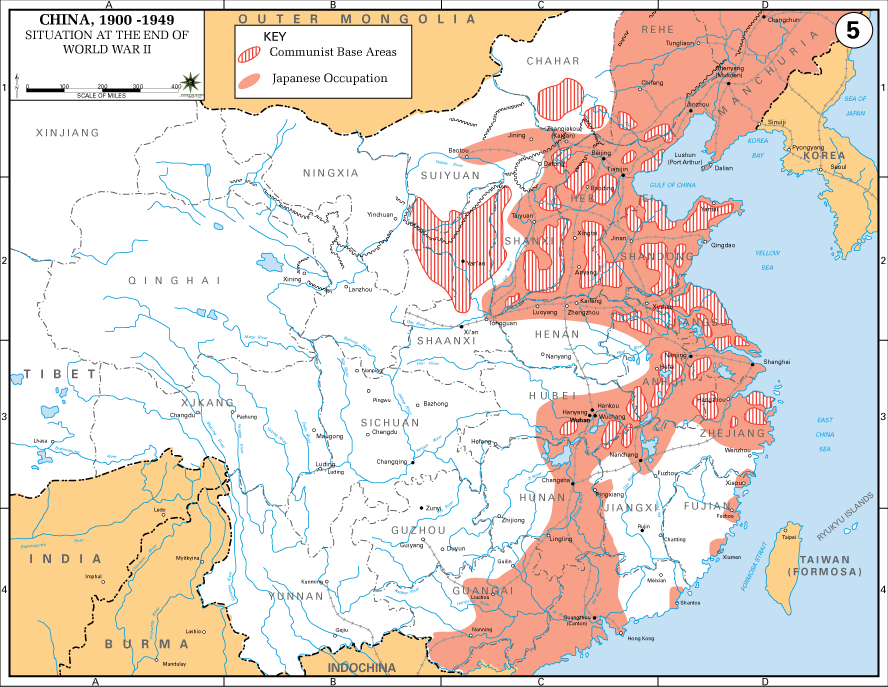

However, the recovery from the collapse proved to be just as long and even more painful. It was accompanied by a series of dramatic crises. In 1927, China plunged into civil war, pitting Chiang Kai-shek's Kuomintang nationalists against Mao Zedong's communists. In addition, Japan seized all of Manchuria in 1931 and began to conquer other lands. It was not until the defeat of Japan by the Americans in World War II that vast areas of Chinese lands were liberated. Before that, the invaders had seized regions crucial to China's economic development. They were virtually cut off from the sea, and thus from the most important transportation routes for the development of the Middle Kingdom.

Za: https://www.pacificatrocities.org/blog/how-much-of-china-did-japan-control-at-its-greatest-extent

The expulsion of the Japanese led to the resumption of the civil war, which was won by the Chinese Communist Party. But it also meant that Taiwan, which remained under Kuomintang rule, became a separate political entity. Meanwhile, even the end of decades of war did not allow the Chinese to rebuild their former prosperity. Mao Zedong, who ruled the country undivided for more than a quarter of a century, was obsessed with catching up with the industrialized West. His period of tyranny led to crazy ideas of throwing the entire nation into building heavy industry under the concept of the "Great Leap Forward" and collectivizing the countryside. This, combined with terror and famine, resulted in the deaths of 20-30 million Chinese and even greater misery for those who managed to survive.

After the failure of the Great Leap Forward and a brief political thaw, a new era of terror was ushered in by Mao's "Cultural Revolution" in 1966. Only the death of the tyrant and the concentration of power in the Communist Party and the state in the hands of Deng Xiaoping brought China the beginning of an era of stability and development in the late 1970s. In retrospect, only Deng's rule can be considered the moment in the history of the Middle Kingdom when the Great Depression came to an end. Thus, the terrible collapse of the superpower lasted about a century and a half, and the sequence of events that triggered and deepened it was initiated by the First Opium War. It was like a single, powerful kick with which Britain opened the gates of the Chinese market wide for herself and others. After that, none of the emperors residing in Beijing managed to close them again. And that meant utter ruin for the Middle Kingdom.

Now it is China that is trying to open the gates to the heart of Europe with its powerful, green kick.

The Chinese are coming

Just a decade ago, the countries of the European Union were leading the way in the technologies and production of the equipment needed for the great transformation that is being planned. It calls for a 55 percent reduction in carbon emissions by 2030 (from 1990 levels), and then to achieve total greenhouse gas neutrality by 2050.

Za: https://www.consilium.europa.eu/en/eu-climate-change/

In order to achieve such a large-scale economic transformation, the devices that are necessary are those that are a source of electricity but do not emit CO2 in their production, namely: wind turbines and photovoltaic panels in particular. In the next stage of the transition, energy storage facilities, which are necessary to stabilize energy systems based on renewable energy sources, and electric cars, which will open a new chapter in the history of the automobile, will become equally important. Once the ban on the registration of new cars with greenhouse gas-emitting engines in the EU comes into force in 2035 (with the exception of certain brands of luxury cars and those powered by synthetic fuels), electric vehicles are expected to dominate the EU market. In the case of battery energy storage and electric cars, batteries are the key design element. And among them, the dominant ones at the moment are: lithium-ion.

Heat pumps should be added to this pool of key industrial products for the economic transformation of the Community countries. After all, according to Brussels calculations, real estate accounts for 40% of total energy consumption in the EU. Plans include switching to heating with heat pumps and photovoltaic systems. This change will be accelerated by the Energy Performance of Buildings Directive (EPBD), which requires all new buildings to be zero-emission by 2030. And for those built before then, 2050 has been set as the deadline for achieving zero emissions. So there will be a massive shift in Europe away from gas stoves, not to mention those fueled by coal.

In order to make key transformational products, you need access to a whole range of very specific raw materials (more on that in a moment) and high-tech components. So when you add it all up, you see a whole new industry that is worth a staggering amount of money and capable of generating equally staggering revenues.

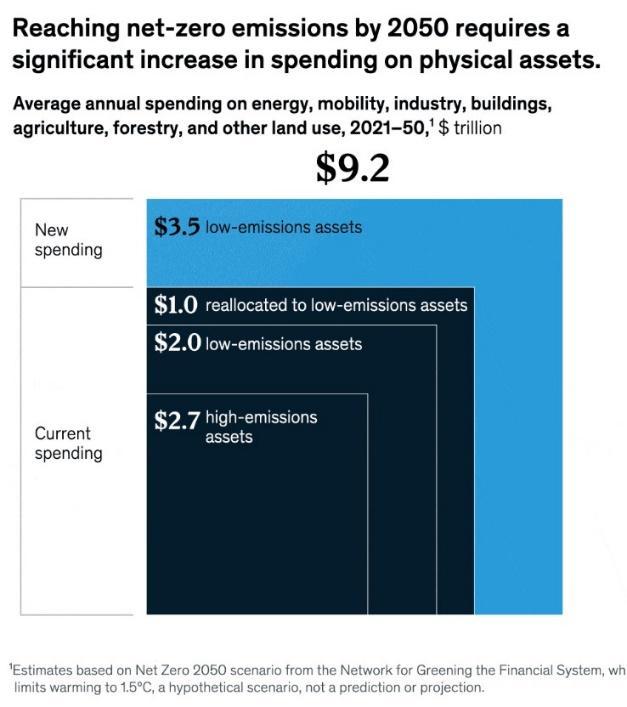

What those sums will be is yet to be estimated. The McKinsey Global Institute (MGI) says in its January 2022 report that: "The transformation of the global economy needed to achieve net-zero emissions by 2050, to be widespread and meaningful, would require average annual spending on physical assets of $9.2 trillion, $3.5 trillion more than today."

Returning to the Union itself, according to the European Commission's estimate presented to the European Parliament in November 2023, investment in the EU's energy sector alone will need to reach 396 billion euros per year by 2030 and 520-575 billion euros per year in the following decades. But if other sectors are taken into account, the EU will need to invest more than 700 billion euros a year to meet its targets, according to the European Commission's July 6, 2023 estimate: "in terms of energy transition and combating climate change."

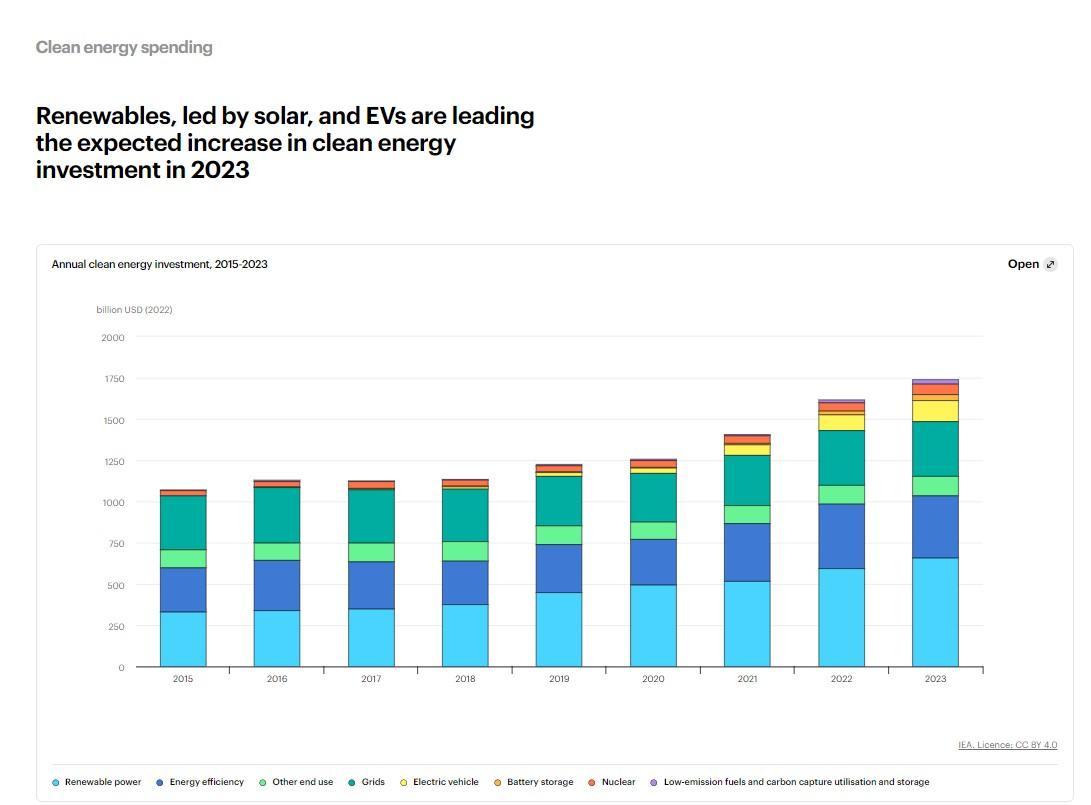

For comparison's sake, let's take another look at what the current global spending is on industries related to energy sources that are considered non-emitting and the equipment needed for the transition. Well, from a report by the International Energy Agency (IEA), we can learn that in 2023, about $1.7 trillion will be invested in this field worldwide. This is about 40 percent more than in 2015. At the same time, the IEA predicts that this amount will double in twenty years.

Za: https://www.iea.org/reports/world-energy-investment-2023/overview-and-key-findings

And thus, a whole new market has emerged in the last decade, with trillions of dollars up for grabs. Admittedly, it is still difficult to estimate exactly how much, but from the calculations that are being made it is clear that more than a third of the projected sums to be spent will be in the pockets of EU residents. As noted here just a decade ago, EU countries were leaders in the technologies and production of the equipment needed for the great energy transformation. And it was European manufacturers who were supposed to share these trillions. But this is not the case, because in this great race, initiated by the old continent, China has gained a huge advantage in recent years. And it is so great that it seems to herald the aforementioned “powerful kick” that will open the gates of European markets to the Middle Kingdom.

Good planning is key

Looking at how Beijing has prepared for Europe's planned energy transition, it is hard not to have great respect for the Chinese planners and the strategy they have adopted. The direction of change for the Union was finally set at the European Council summit on December 12, 2008. At that time, the leaders of the EU countries agreed to adopt an energy and climate package. It mandated their countries to achieve by 2020 the "3x20 target", i.e. to reduce CO2 emissions by 20%, to increase energy efficiency by the same amount, while electricity from renewable energy sources should cover at least 20% of market demand. The European Commission was tasked with drafting directives outlining what changes needed to be made to achieve the strategic goal.

At the time, Beijing was making a concerted effort to monopolize the world's rare earth resources. These are 17 hard-to-find elements, including neodymium, gadolinium, terbium, dysprosium, and erbium, which are essential to the construction of modern electric motors, batteries, photovoltaic panels, wind turbines, lasers, and more. As early as the 1990s, their deposits attracted the interest of the Chinese authorities, who did their best to take control of the emerging market for new raw materials. It did so with ease, as the rest of the world missed the start of the race. Soon, Beijing controlled 90 percent of the world's rare earth exports.

In an analysis entitled "The Strategic Importance of Rare Earth Metals," Daria Wiejaczka and Witold Wilczynski point out that: "The monopoly position has allowed China to set prices," while "Export restrictions in 2009-2010 led to a multiple increase in rare earth prices".

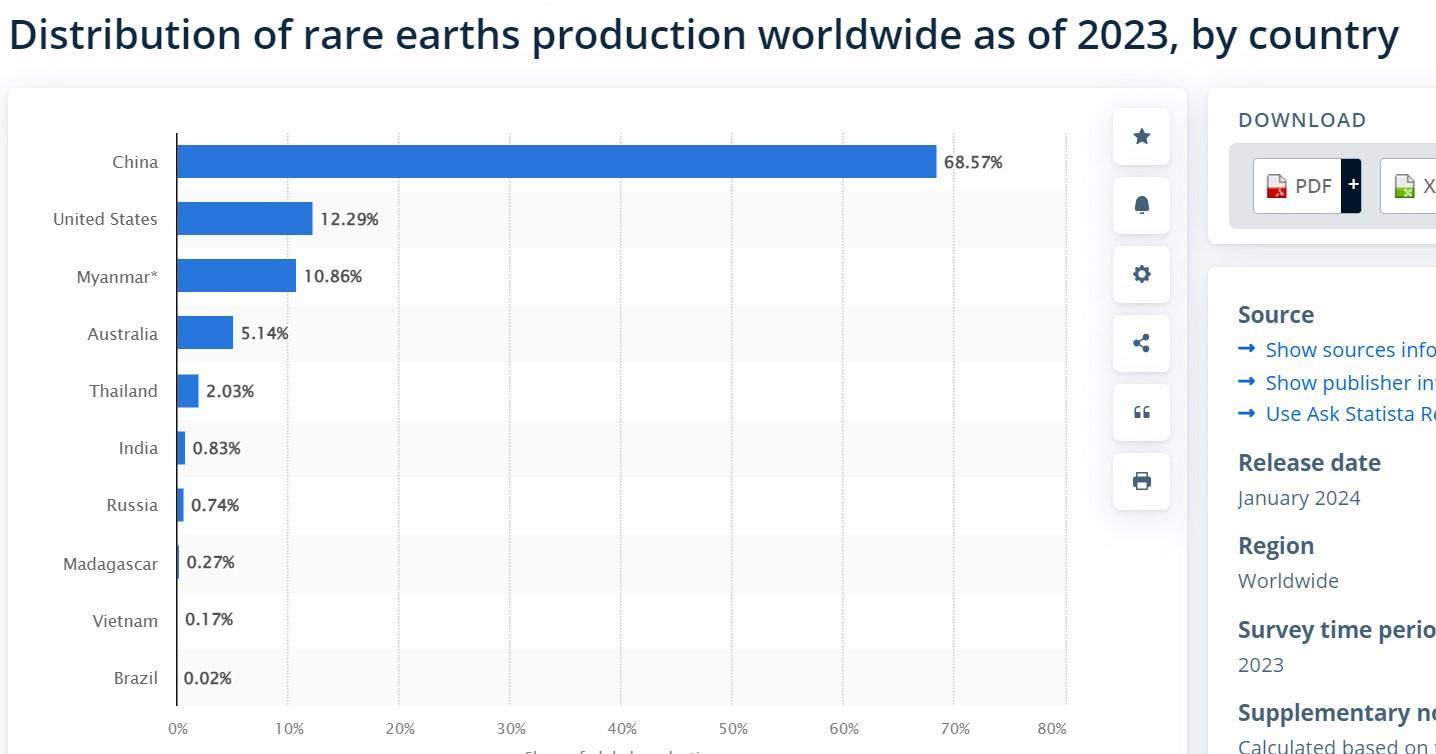

Only after 2010 the West realized that if China maintained its monopoly on strategic metals, it would ruthlessly exploit this fact and impose its terms on all countries embodying the "green transition". So, in a panicked rush, the search for new deposits began. The effects of these efforts, although visible, did not break China's dominant position. In 2023, the Middle Kingdom still accounted for 68.57 percent of the world's rare earth mining, followed by the United States with 12.29 percent and Myanmar with 10.86 percent. Not a single European country was among the major producers.

Za: https://www.statista.com/statistics/270277/mining-of-rare-earths-by-country/

It was not until January 2024 that it was triumphantly announced that the Swedish mining company LKAB had discovered huge deposits of rare earth elements in Kiruna, located in the north of Sweden. If all goes well, their mining will go into full swing in just ... ten years.

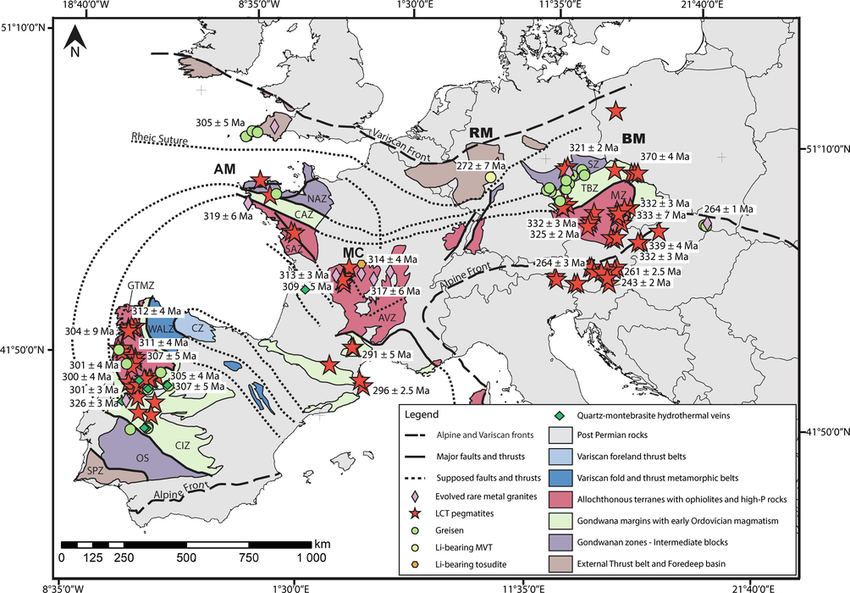

The same is true for mines of lithium, which is indispensable during the energy transition. Its large deposits have been discovered in: Czech Republic, Germany, France, Spain, Portugal, Serbia and Ukraine. But at the moment Portugal is the only EU member state mining and processing lithium. Everywhere else preparations are only just being made to start exploiting the discovered deposits of the raw material. It is estimated that the first batch of ore, for example, from the French deposit in the Massif Central (Allier department) will hit the market in 2028.

Euope’s lithium deposits:

https://www.researchgate.net/figure/Simplified-geological-map-of-the-Variscan-orogeny-in-Europe-location-of-various_fig6_332613034

With a similarly punishing delay, it wasn't until the end of 2023, that the European Council and the European Parliament agreed on the adoption of the European Critical Raw Materials Act (CRMA). It is intended to accelerate efforts to make the EU self-sufficient in raw materials, so that by 2030 no more than 65 percent of the Union's annual demand for 17 strategic metals will be met by countries outside the Union. Meanwhile, the rest of the rare earths are to come from recycling and domestic mining.

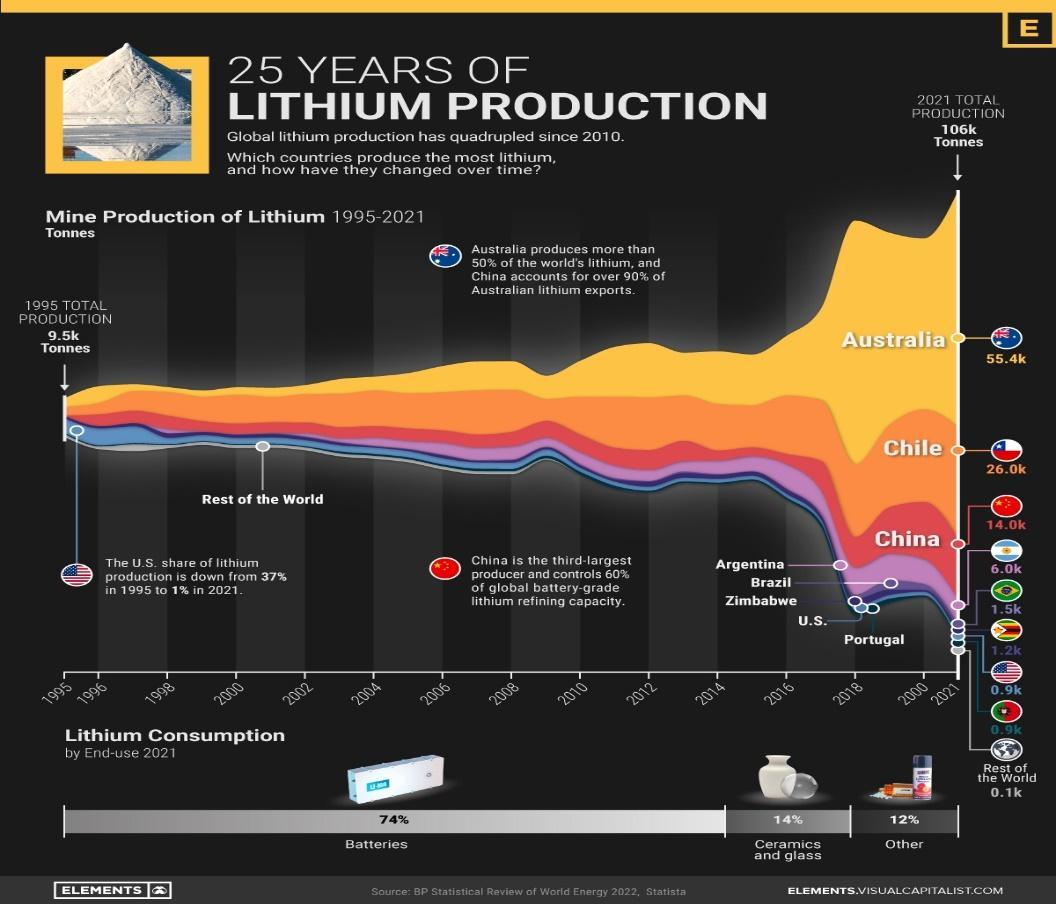

Beijing's dominance in the field of raw materials crucial to the "green transition" alone makes it clear that China's planners have long since made an excellent analysis of what EU countries and their companies will have to spend huge sums on. Their bad luck was that lithium deposits are quite widespread around the world, and the largest of those discovered are in Australia and Chile.

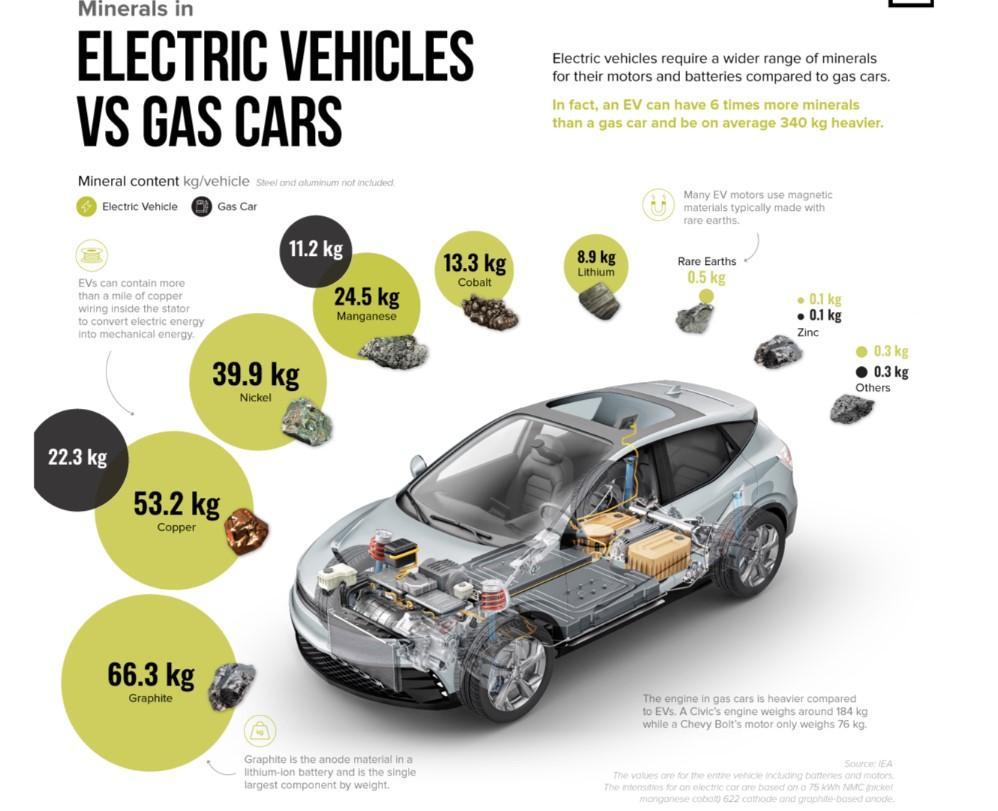

However, Beijing has more than made up for this disadvantage in synthetic graphite production. By 2025, Chinese producers are expected to reach an annual production capacity of 4.6 million tons of this raw material, which will account for 92 percent of global demand. To understand what this means, it is enough to know that a car powered by an internal combustion engine requires no graphite at all in its construction. The average electric car uses almost 70 kg.

Za: https://elements.visualcapitalist.com/evs-vs-gas-vehicles-what-are-cars-made-out-of/

So when an action plan called the European Green Deal was announced in Brussels at the end of 2019, which included the redirection of large sums of EU resources to investments in the "green transition", China already had a crushing advantage in the field of access to key raw materials. Enough to reduce the Old Continent to the role of a dependent consumer. Just as the East India Company once made the Chinese dependent on the opium it supplied.

98 percent of the rare earth elements imported by European Union countries in 2022 came from China, but it didn’t make the Chinese take a break. Since President Xi Jinping announced the One Belt, One Road (OBOR) project, colloquially known as the New Silk Road, in 2013, Chinese companies have successively sought to take over Africa's largest deposits of rare earths, lithium and cobalt. A very helpful tool for this is infrastructure projects and the fact that Chinese banks have become major creditors for about 20 African countries.

And this is far from the end. In addition to building a rare earths monopoly, the Chinese are also on the quest for world domination in the field of lithium-ion battery production. Thanks to constant financial support from the state, CATL, BYD and a number of smaller companies have been expanding their production and improving their products over the past decade.

By the end of 2023, China's CATL had a global market share of nearly 37 percent, followed by China's BYD with 15.8 percent, and South Korea's LG Energy Solution with 13.6 percent. As in the race for strategic raw materials, the old continent and its companies are at the bottom of the heap. Completely helpless against the competition from Asia. They have to come to terms with the fact that almost 60 percent of the world's production of batteries, which are used in electric and hybrid cars as well as smartphones and laptops, has been taken over by the Chinese.

The bad news for Europe does not end there. In the market for photovoltaic panels, products made in China are much cheaper than those made in Europe. This is due to the price of electricity in China (on average three times cheaper than in the EU), access to rare earth metals, government subsidies and technological sophistication.

The Financial Times newspaper warned on September 11, 2023: "Fierce competition from Chinese manufacturers for market share in Europe has caused the price of photovoltaic panels to fall by more than a quarter on average." As a result, European manufacturers were on the verge of bankruptcy, followed by others. According to the FT, two-thirds of Europe's photovoltaic panel market has already been captured by companies from the Middle Kingdom. Meanwhile, solar energy is expected to become the largest source of electricity in the bloc by 2030. According to the Financial Times, the EU is in danger of "becoming as dependent on China as it was on Russian gas before Moscow's full-scale invasion of Ukraine."

Shortly thereafter, another industry associated with Europe's "green transition" sounded the alarm. CEO of Siemens Energy AG, Europe's largest wind turbine manufacturer, Christian Bruch on February 21, 2024, in an interview with the South China Morning Post (SCMP) announced: "The wind energy sector in Europe will suffer the same fate as the ruined photovoltaic industry, if the authorities do not restrict market access to cheaper Chinese equipment".

The company, owned by Siemens, was saved from bankruptcy in late November 2023 by a 15 billion euro aid package. Half of the sum consisted of loan guarantees from the German government, and the rest of bank loans and subsidies from the parent company. However, this financial injection may prove to be only a prolongation of the agony of this wind turbine manufacturer, which, together with Spanish cooperatives, is the world's second largest company in this industry. The first place is still held by the Danish company Vestas Wind Systems A/S. However, four of the top 10 wind turbine manufacturers are Chinese companies. One of them, Goldwind, is on the verge of overtaking Siemens Energy. This may be made easier by the fact that, according to recent announcements by Chinese manufacturers, they will soon be able to offer wind turbines with a rated output 30 percent higher than Western turbines and 70 percent cheaper. It should also be mentioned that, for example, 60 to 70 percent of wind turbines manufactured in Germany contain components from China.

Christian Bruch therefore called on the European Commission to take steps to give his company a chance to survive the onslaught of competitors from the Middle Kingdom. Among other things, he suggested launching an investigation into the Beijing government's subsidization of domestic wind turbine manufacturers and restricting access to wind power auctions. This could be done by making the ability to participate in the auction dependent on qualitative factors, such as the country in which the bidder conducts development research or whether it manufactures turbines from recyclable materials. But then the retaliatory measures that Beijing could take against the Union would become even stronger.

As the European Commission began to float plans to defend the EU market from Chinese expansion, China announced in a warning "growl" as early as July 2023 that it would impose restrictions on gallium and germanium exports to the EU and, incidentally, to the United States.

Despite EU diplomatic efforts, China not only did not reverse the restrictions, but added an embargo on graphite at the end of 2023. The cutoff marks a painful blow to electric car and battery manufacturers, and represents what could be called a ladder of escalating tensions. Beijing is starting with the raw materials least needed by the West, and gradually adding the more essential ones.

"China's actions on graphite pose significant risks to the stability of electric vehicle supply chains and highlight the fragility of reliance on critical materials from China," - emphasizes U.S. consulting firm FTI Consulting in its analysis. "Significant restrictions on graphite exports (from China - author's note) could not only disrupt the rapid development of electric vehicles and thus undermine decarbonization efforts, but the effects could be felt more broadly, given the use of graphite in a range of applications, including advanced semiconductors," - the report added.

Meanwhile, the European Commission, which is just looking for ways to bail out European manufacturers of photovoltaic panels and wind turbines, faces an even bigger challenge, which turns out to be the protection of domestic car companies, led by German ones, which are one of the cornerstones of the German economy. Key, after all, to the functioning of all the Union.

The largest of the German car companies, Volkswagen Group, sold 578,000 electric cars worldwide in 2023. Forecasts for the current year look bleak, as they say that sales will fall to about 450 thousand units.

And now let's look at the results of the largest of China's electric car manufacturers, BYD. It sold 911,000 electric cars worldwide in 2022, and already 1.6 million last year! (plus twice as many hybrids). This is an increase of more than 60 percent in one year! In this segment, BYD (along with a whole conglomerate of smaller companies from the Middle Kingdom) is gradually pushing German companies out of the Chinese market. And now it has set out to conquer Europe, building its first factory within EU borders in Szeged, Hungary.

Za: https://www.fool.com/research/largest-ev-companies/

Not surprisingly in this context, on September 14, 2023, the President of the European Commission, Ursula von der Leyen, announced that the European Commission would launch an anti-subsidy investigation against Chinese car companies. As a result, as of March 6, 2024, all electric vehicles entering the European Union from China could be hit with punitive anti-subsidy tariffs.

Interestingly, the investigation itself is not expected to be completed until November of this year. However, the European Commission has decided that the situation has become too dangerous for EU automakers and cannot wait until the end of the investigation before making a decision. It also said that the evidence of the Chinese government's subsidization of domestic car companies is so strong that there is no point in further delaying punitive tariffs.

In the EU, only heat pump manufacturers are not sounding the alarm yet. Although about 35 percent of production capacity is in China, 25 percent is in the United States and just under 20 percent in the EU.

In all other industries related to the "green transition" the situation is bad or very bad.

However, the first determined attempt to slam the door to Europe in Beijing's face may not be very effective. Committed to pursue full-scale economic expansion, Xi Jinping has a full deck of cards to play against the Old Continent. After all, the United States is much closer to self-sufficiency in raw materials and has proven itself capable of taking decisive and radical defensive measures. Increasingly effective in protecting its own companies. The European Union, on the other hand, looks less like an adversary and more like a potential victim, all the more attractive because it is very rich. This impression is reinforced by the fact that close cooperation with China is urgently needed by Berlin, which sees it as a way of pulling the German economy out of recession.

Symptomatically, in 2023, when all foreign investors began to move their capital away from China, only German companies went against this trend. That's why the Middle Kingdom's share of German direct investment abroad reached 10.3 percent last year, the highest since 2014.

So while the European Commission has stepped in to defend the EU market, the Federal Republic of Germany continues to strengthen its ties with Beijing. This could mean that the intensity of Brussels' defense efforts will remain limited. And also dependent on not provoking China into new sanctions that could hit German industry.

Admittedly, at the EU-China summit in Beijing on December 7, Ursula von der Leyen, accompanied by European Council President Charles Michel, demanded that Xi Jinping change China's economic policy. However, there is no indication that China's indivisible communist emperor, called president for the sake of disguise, took her words to heart. Especially that part of von der Leyen's statement when she announced that: "European leaders will not tolerate our industrial base being undermined by unfair competition."

Especially when those words are juxtaposed with the fact that the EU's trade deficit with China has grown from 40 billion to 400 billion euros over the past 20 years. And somehow this has been tolerated until now.

In response, Xi politely told the European guests, aka ‘barbarians’ that: "We should not regard each other as rivals just because we have different systems, limit cooperation just because there is competition, or engage in confrontation just because there are differences." Less politely, he then demanded that the Union stop cooperating with the United States on sanctions aimed at restricting the development of China's technology industry. In return, he promised Europe an important place in the new multipolar world.

And so China continues to break down the gates to Europe. This time it's the Europeans who seem helpless against the actions of the newcomers from a distant land, and one industrial sector after another, like XIX century China’s ports and economic zones, is being taken over by the nimble and determined invaders. Meanwhile, the "modern opium" for European decision-makers has become something they so desperately want - green transformation products, on which the Chinese are eager to make them dependent.