- Hubert Walas

Hiperinflation.

The 2020 Covid Pandemic has wreaked havoc on globalized economies around the world. Lockdowns, suspended supply chains, working from home - all this caused the global economy to shrink by nearly 5%, or over $4 trillion dollars, in just one year. After the initial shock, most governments started bailing out, pumping huge sums into their economies. McKinsey calculated that, overall, world governments have already allocated over $10 trillion to relief plans. Almost every central bank couldn’t keep up with the printing of the new money, however the US Federal Reserve dropped $5 trillion in financial aid from the proverbial helicopter to Americans. Everyone at some point in their life learns why money cannot be printed indiscriminately and that the economy can not work this way in the long term. Prices are rising, and inflation is now being felt by almost everyone in the world in one way or another. What will the consequences be? Unfortunately, everything seems to suggest the unpleasant. Today, we will look at the symptoms of the impending recession with the example of the world’s largest economy and now also the largest printing house in the world - the USA.

The charts and conclusions here are mainly the results of the work of David P. Goldman and his Asia Times column. David was one of the few economists who predicted the 2008 crisis, and his current conclusions can be summarized briefly: "You should be afraid."

However, to get to the point: Biden's plan to throw $5 trillion into the gears of the US economy would not necessarily be bad if it was to overhaul its engine - industry and production. In fact, these would have to be almost totally re-engineered as, in recent years, all their parts have been shipped out of the US and placed all over the rest of the world, especially in China. While in the United States, only software programming has remained in place and it, in fact, provides the largest margins. However, without industry, the economy becomes vulnerable. Unfortunately, Biden's aid package does not offer a fishing rod, but a fish, i.e. most government expenses are social expenses, or simply throwing money to the public. The following will show the short-sightedness of such a strategy.

The first chart we will look at today shows investments in capital goods, i.e. things that are used to produce other goods, such as machines, raw materials, or tools. It shows two things: first of all, the total dominance of investment in the technology sector over all other sectors, that is ‘software’ vs. ‘hardware.’ Secondly, the fact that pumping trillions of dollars into the economy gave an investment effect only in information technology - i.e. streaming platforms, remote work software, games, etc - while investments in heavy industry, production, mining, and oil industry look almost as if there was no support.

One-off support with an avalanche of money will not solve years of infrastructure and industrial neglect. Therefore, the sudden appearance of a large amount of new money in circulation caused a demand shock in the United States due to an increase in purchasing power and a supply shock, where American business is unable to produce and fulfill orders.

The June survey of The Institute for Supply Management clearly shows this. The so-called “bottleneck index”, i.e. the timeliness of deliveries to prices, is the highest in 40 years. In a word, prices are very high, yet delivery times are long. The problem is that the Biden administration is pumping trillions of dollars into an economy that has been underinvested in infrastructure for 2 decades. America's supply chains are tearing at the seams.

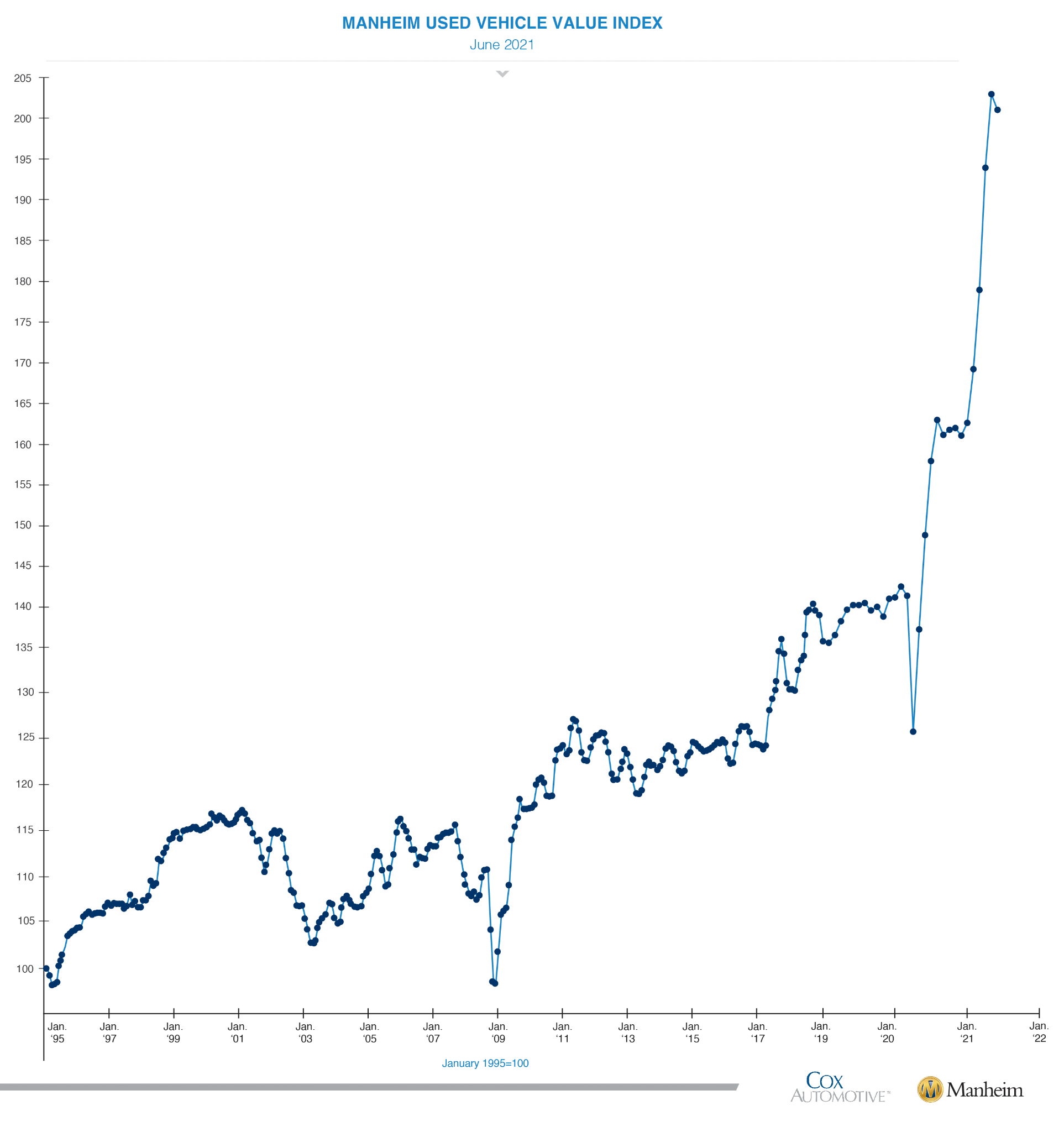

The amount of money in the market and the inefficiency of the economy show the car market well. American automotive manufacturers produced nearly 2 million fewer cars last year than before the lockdown. The problem is primarily caused by the shortages in the availability of microprocessors, which, as experts predict, may continue even until 2023. So what happens when there is a lot of money on the market that cannot be spent to buy new cars? Simply put, the used car market is exploding. The latest report from the Manheim Used Vehicle Index, the industry standard for monitoring wholesale used car prices, shows that used vehicle prices have increased by more than 50% since the start of 2021. About 200% of the cumulative rate per year.

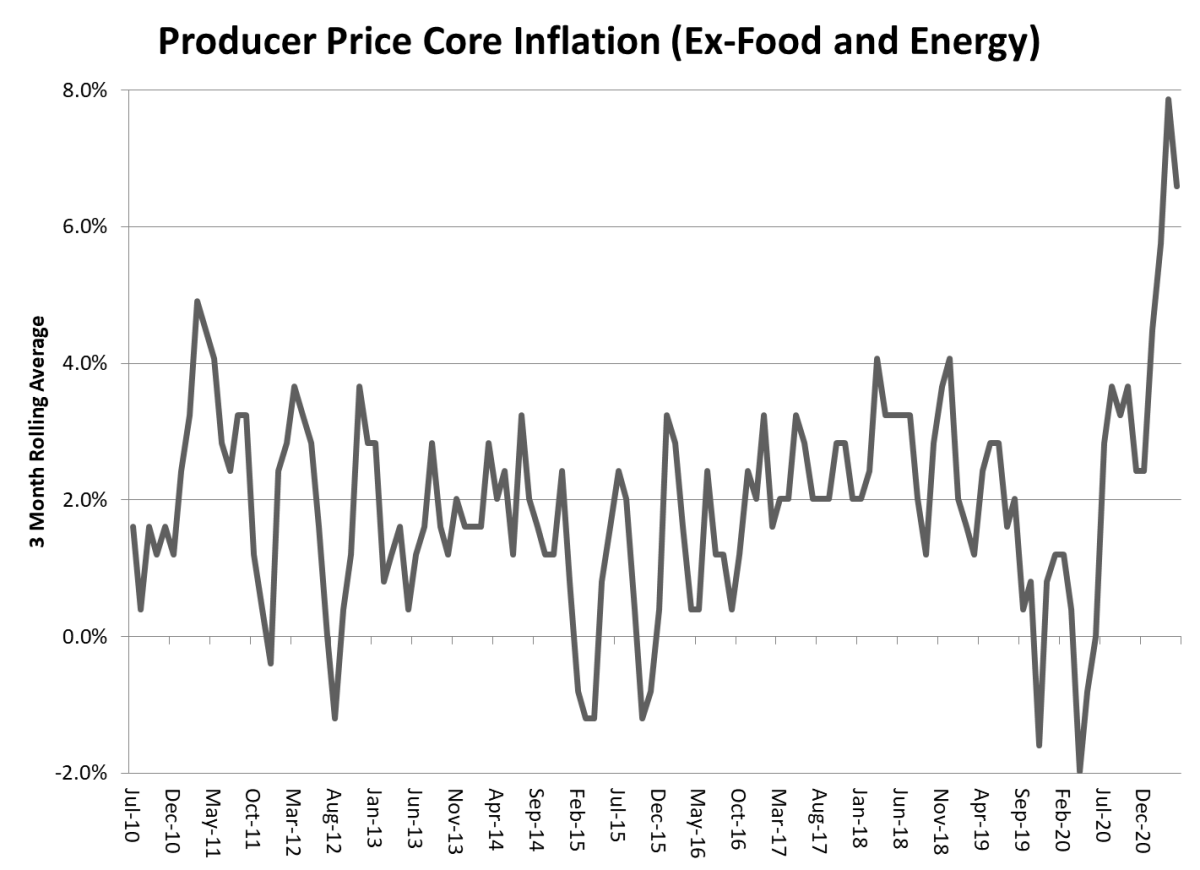

Producer and consumer price indexes also leave no room for doubt as to what we are dealing with. The chart of core producer price inflation, excluding food and energy, has already hit a record since the survey began in 2010.

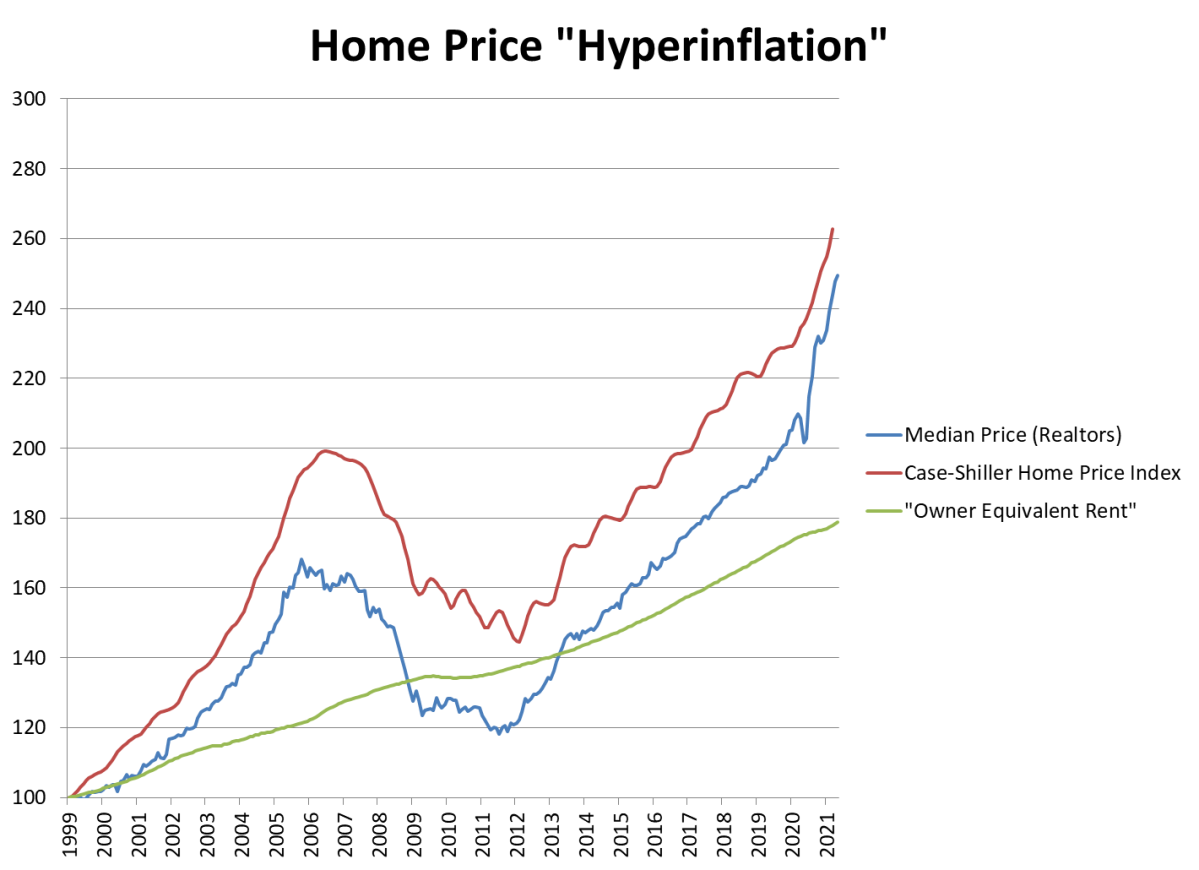

The same is the case with consumer prices, which grew by 8.7% in May and 11.6% in April. The United States has not seen inflation of this magnitude since the crisis of the 1970s. But even this alarming measure underestimates actual inflation. House prices are rising at a rate of 26% per year, almost ten times faster than the government's measure of home price inflation, the so-called Owner's Equivalent Rent. The two soaring charts are the median house price among Realtors and the Standard & Poor’s Case-Shiller Home Price Index.

American households aren't stupid. They see rising prices everywhere. And they know that the best long-term hedge against inflation is home ownership. 30-year mortgage rates are now below inflation for the second time in history. The first was in 1974 when homes were the only asset class in the US to record positive returns for the remainder of the decade. The housing bubble is the rational choice of a portfolio by households trying to hedge against inflation. It is a long-term hedge, motivated by the expectations of lasting, persistent, and high inflation - just like in the 1970s.

Despite all these red warning signs, the Fed argues that inflation is only temporary and blames the Pandemic. Most economists believe in the Fed's assurances, but with each passing day that number is getting smaller and more of them are predicting stagflation, that is a long-term increase in prices combined with an economic slowdown. Consumers reject higher prices and producers limit production because input costs are too high to be passed on to reluctant consumers. This is what David Goldman, as well as Deutsche Bank analysts, who in their report shared Goldman's conclusions, are predicting. Deutsche chief economist David Folkerts-Landa criticizes the Fed's social priorities and fiscal policy, and calls it a "ticking inflation time bomb."

The Deutsche team, like Goldman, predicts that the upcoming inflation may be reminiscent of the 1970s, a decade where inflation averaged almost 7% and was double-digit at various times. What did the Americans do then? During the 1970s crisis, the Fed drastically raised interest rates from 7.4% in June 1978 to 20% in March 1980. This knocked inflation down, but at the cost of a deep recession until the Reagan tax cuts. Is a similar scenario also possible now? In 1979, the USA’s federal debt was around 30% of GDP. Now that's more than 130%. Thus, a 5% increase in interest rates would cost the treasury an additional 1.5 trillion dollars in debt servicing. Which is almost twice as much as the defense budget. The spiral thus closes.

All economic indicators show that people are trying to get rid of money, which is losing value every day, but the American market is not keeping up with meeting these needs. All demand and no supply means inflation. However, perversely, the Americans have an paradoxical ally in this situation. Only one economy in the world has enough capacity and a robust supply chain to cope with this demand magnitude and, of course, that is China.

China is inundated by the dollar. American demand is met by Chinese exporters and thus forces billions of dollars into the Chinese economy, which naturally causes an increase in the value of the Chinese currency, the yuan. The Chinese authorities do not necessarily want this, as it affects the export competitiveness of the Chinese economy, so they are fighting the appreciation of the yuan by swapping their $ 500 billion positive trade balance with the US by buying US bonds. Economists call this marriage "Chimerica." America is borrowing and importing. China is lending and exporting. This has a double effect - the prices of imported products are rising while the US trade deficit is deepening.

Nevertheless, even the Chinese themselves see the problem. Guo Shuqing of the People's Bank of China said: “The magnitude of inflation is higher than the expectations of central bankers in the United States and Europe, and the duration of inflation does not seem to be as short as many experts predict. When fiscal expenditures are already largely supported by the central bank’s printing of money, it is like an airplane entering a tailspin, and it is difficult to pull out of the dive. Before 2008, the Fed’s balance sheet was only more than $800 billion, and now it is nearly $8 trillion, and the ratio of US federal debt to GDP has surpassed the highest record created during World War II.”

However, he continues, China will be happy to help: “For a considerable period of time, China has supplied about half of the world’s finished goods, and on the whole has not increased export prices, laying a solid foundation for global epidemic prevention and control, and for economic recovery. If the large amounts of currency issued by the most developed countries have been the driving force for global inflation, then the goods produced by China’s hundreds of millions of workers are the anchor for stabilizing global inflation.”

In other words, the Chinese say - if you take our products, we will take your paper, which you have printed indolently. As a result, the US administration's policy towards Beijing must be cautious, as China is currently the safety valve for the American economy. That is why the de facto relationship between the great powers has lost intensity. It's not necessarily the difference between Trump and Biden's personalities that makes the Uyghurs, the ‘China virus,’ or calls for democracy, etc. less audible lately, but rather calculated politics. Biden must take money from China and tone down the trade war to prevent his economy from collapsing altogether. And there are many indications that the US economy is now more dependent on China than ever in the future.

If China stopped buying the US currency, the RMB, or Chinese yuan, would start to appreciate quickly, and the US economy would suddenly find itself in very big trouble.

If at this point you are happy that you are not affected because you are not a US citizen, then I have some worrying words. First of all - the printing of money in the United States has a significant impact on the world situation due to the fact that the US Dollar is the world's reserve currency. It accounts for over 60% of all known central bank foreign exchange reserves, or about $7 trillion. Almost 40% of the world's debt is issued in dollars. 80% of world trade is in the dollar. So the cost of American reprinting falls on each of us. Secondly, there is a high probability that your government has recently made a similar maneuver as the US Fed, only on a smaller, local scale.

Which economies outside the US are the most vulnerable to the coming crisis? Rob Subbaraman, the chief economist of Nomura Holdings in Japan, created a model that includes measures of outstanding private credit and debt, as well as property and equity prices. It correctly identified two-thirds of the last 53 crises in 40 economies since the early 1990s.

So what does it show? The US is in the lead. Behind it, we have the buoyant economies of Japan, Germany, Taiwan, Sweden, and the Netherlands. After adding the shock factor, which is high interest rates, the economies of France, Hungary, Poland, Romania, New Zealand, Portugal, Hong Kong, Iceland, Switzerland, Thailand, Chile, and Canada are also starting to look bad.

To paraphrase David Goldman - "We all should be worried."

Sources:

https://asiatimes.com/2021/06/its-1979-again-but-with-quadruple-the-debt-burden/

https://www.tampabay.com/opinion/2021/01/18/how-much-federal-debt-is-too-much-column/

https://www.crfb.org/papers/updated-budget-projections-show-fiscal-toll-covid-19-pandemic

https://www.mckinsey.com/~/media/McKinsey/Industries/Public%20Sector/Our%20Insights/The%2010%20trillion%20dollar%20rescue%20How%20governments%20can%20deliver%20impact/The-10-trillion-dollar-rescue-How-governments-can-deliver-impact-vF.pdf

https://blogs.lse.ac.uk/internationaldevelopment/2021/05/18/the-coming-financial-crash/

https://www.thebalance.com/world-currency-3305931

https://www.thinkadvisor.com/2021/06/02/longtime-bank-lawyer-predicts-where-next-financial-crisis-will-come-from/

https://www.bloomberg.com/news/newsletters/2021-06-24/what-s-happening-in-the-world-economy-bracing-for-the-next-financial-crisis

https://asiatimes.com/2021/05/who-you-gonna-believe-the-fed-or-your-own-eyes/

https://asiatimes.com/2021/05/nothing-transitory-about-this-inflation/

https://asiatimes.com/2021/06/the-fed-is-the-culprit-in-commodity-inflation/

https://www.businessinsider.com/stimulus-package-pandemic-surpass-great-recession-fiscal-plans-recovery-2021-3?IR=T https://asiatimes.com/2021/06/china-struggles-to-hold-back-yuan-appreciation/

https://asiatimes.com/2021/06/china-can-help-us-out-of-its-inflation-trap/

https://asiatimes.com/2021/06/blowout-us-inflation-report-hides-the-ugly-truth/

https://asiatimes.com/2021/06/all-demand-and-no-supply-means-inflation/

https://asiatimes.com/2021/06/the-enduring-triumph-of-chimerica/

https://asiatimes.com/2021/06/producer-prices-jump-real-earnings-fall-sales-drop/

https://asiatimes.com/2021/06/fed-talk-of-2023-rate-hikes-spooks-markets/

https://asiatimes.com/2021/06/1st-sign-fed-fears-hit-long-term-real-yield/

https://asiatimes.com/2021/06/fed-starts-to-signal-recession-fears/

https://asiatimes.com/2021/06/fed-worries-that-inflation-will-become-stagflation/

https://asiatimes.com/2021/06/now-its-home-price-hyperinflation/

https://asiatimes.com/2021/06/asset-bubble-boom-and-bust-frightens-the-fed/

https://asiatimes.com/2021/07/worst-inflation-in-30-years-even-worse-than-it-looks/

https://www.cnbc.com/2021/06/07/deutsche-bank-warns-of-global-time-bomb-coming-due-to-rising-inflation.html