- Andrzej Krajewski

“Our previous development model is over. We are over-regulating and under-investing. Within two or three years, if we follow our default plan, we will fall out of the market [...] Mario Draghi has just published a report, and his tone seems very pessimistic. The Union may die, and we are one step away from a very important moment. I think this is true,” Emmanuel Macron announced on October 3 at the Berlin Global Dialogue conference.

In pessimistic words, the French president noted that in the economic sphere, the United States and China have left Europe far behind. He added that since China and the United States no longer follow the rules of the World Trade Organization (WTO), the EU should not follow them either. The French president called for speed and efficiency in implementing the recommendations of Mario Draghi's report, if the EU wants to survive.

The French president expressed in fiery terms what many Europeans have been feeling, subliminally, for a long time. First, for several years now, China has been chasing Europe away on the "innovation express," and later, based on the policy of reindustrialization and its technological champions - the Americans, and Europe? Being naughty, one could say that the Union has been left with the largest AI regulatory playbook before this most disruptive technology in the world today even had time to grow here.

The Lost Union

Indeed, none of the great economic powers of the modern world is as lost today as the European Union. Of course, when we talk about the Union, we are talking about 27 different countries. Let's look at the growth of real GDP (and therefore taking inflation into account) since the financial crisis of 2008, and then compare it with the US. On this map we see the cumulative growth of the last 16 years, adjusted for inflation, originally published on Platform X by Oxford Economics economist Daniel Kral. There we have Poland, which, as the author of the graph notes, "plays in a different league," with real GDP growth of 60%. The Central and Eastern European region generally looks very solid: Romania, Lithuania, Slovakia, Hungary or Bulgaria. It may come as a shock to many, however, that the great United States grew in tandem with these countries (not counting Poland). The economy of the wealthy United States has grown by a staggering 36 percent over the past 16 years. In theory, the map shows that the vast majority of European countries have grown more or less, but only a direct comparison with "Uncle Sam" shows the magnitude of the gap. We can see this in the comparison map now. Only three EU countries have managed to keep up with America, and still these were starting from a lower base, and are generally below the EU average. The others are far behind.

Italy, not to mention Greece, are still at a lower level than in 2008. Spain, Portugal and Finland have practically come to a standstill. Finally, we also have the legacy of Charlemagne, the core of today's Union - Germany and France, whose economies have grown by only 15% in 16 years, but in relation to the US, the "engine of Europe" is a full 20% behind America. Enormous gap.

These changes can be seen even more clearly in the chart of nominal growth. According to the World Bank, in 2008 the Union had a larger GDP than the United States (16.3 trillion versus 14.8), although it cheated a bit by adding new members from the east of the continent. Since then, however, the Union has grown by "only" 2 trillion in nominal terms. America? It has almost doubled the value of its economy, which is now valued at $27.4 billion. What's more, according to the bank's analysts, the Union is already officially and nominally a smaller economy than China.

And it doesn't stop there. According to forecasts by Deloitte Global's Center for Economic Research, the United States will see GDP growth of 2.7 percent this year, while the Union's growth is estimated at around 1 percent - so Uncle Sam's runaway will continue.

This is because, among other things, Americans are now turning on additional economic turbochargers in the form of protectionist tariff policies and a new industrial policy (which we talked more about in the material "US industrial power is back". Let's listen:

“ Literally, from month to month, investment in inputs has gone from $60-70 billion per quarter to about $140 billion. Thus, the index has more than doubled, which is a harbinger that change is coming to US industry. There is a chance that the process of reindustrialization in the United States will surprise with the pace of change and its momentum. All it will take is for U.S. and foreign capital to love the U.S. again”.

But America is only one point of reference. As recently as 2000, the Union's economy was nearly 7 times larger than China's! It took only 23 years for it to become... smaller. That tectonic shift happened in just one generation.

Yes, China has its own problems - from its real estate sector to its investment sector to its demographics. But even pessimistic growth forecasts talk about growth rates for China that are at least 2-3 times better than those projected for the Old Continent.

China has linked its growth much better to technologies related to the energy transition and products based on them. European companies involved in the production of: photovoltaic panels, wind turbines, electric cars are successively weakened and then eliminated from the market by Chinese companies. In the field of battery production, Europeans are practically vegetating. More on this, in the material "How China Conquers Europe via EU's Green Deal?”)

So, the Union today is watching the backs of its two biggest competitors, and it's not clear whether it won't stay that way forever. If it doesn't break this negative trend, it will continue to roll downhill, and then the very concept of "European Union" may become a thing of the past. If the format that was supposed to be a contribution and a new stimulus to growth for all European countries turns out to be an anchor that holds back their development, then the voices calling for the death of the European Union will grow louder and louder. Voices which, let us not forget, can already be heard from time to time, albeit for the moment from the more radical groups.

Will Europe, which is rich after all, experience what usually happens when a former power can no longer hide its inertia and vulnerability? A power that for centuries has accumulated enormous wealth on its territory. Because then there are actors and states who, sensing weakness, step in and take what they feel like taking, because there is simply no one to stop them. Just as in the 19th century, the wealth of China, paralyzed by a political crisis, was appropriated by the European powers. As long as there is great temptation and opportunity, the rest is usually just a matter of time.

It was therefore high time for a wake-up call. And indeed, one was heard in early September 2024. It came late, the question remains whether it was not "too late" and whether it would be loud enough to motivate fundamental change.

Three times a charm, as the old saying goes. Since the beginning of the 21st century the European Union has made two attempts to implement comprehensive strategies to restore its economic glory. The first attempt ended in failure, the second in disaster. It is therefore time for a third attempt. If it fails this time too, it could be the Union's last. Let's take a look at Draghi's report, then we'll look at history a bit to get back to modern times. Welcome to the Twenties Report.

Draghi’s report

"Economic growth in Europe has been slowing for a long time, but we have ignored it until now. I would say that two years ago we wouldn't have had a conversation like the one we're having here today." - Mario Draghi said at a special press conference in Brussels on September 9, 2024.

Earlier, European Commission President Ursula von der Leyen gave a longer speech. Announcing the report prepared under the auspices of the former head of the European Central Bank and then prime minister of Italy. Enjoying the fame of the man who, with his decisive actions, led the eurozone out of the crisis a decade ago and saved it from collapse. According to von der Leyen's account, the EC president called Draghi a year ago and asked him to take it upon himself to prepare a report diagnosing why the European economy was getting worse and worse, losing out in competition with the economies of the United States and China. After a few days of hesitation, the former ECB chief took on the task, enlisting the help of European Commissioners, Commission staff, academics and analysts working for companies and think tanks. In total, there were nearly 230 sources of information and analysis from: institutions (including the OECD and the International Monetary Fund), companies (BASF, Amazon, Google, among others), organizations and individual experts, including the prominent economists like Daron Acemoglu and Olivier Blanchard.

It is symptomatic that no person or institution from the Central European countries took part in the Draghi report, although they are also members of the Union and, to top it all, they have grown much better than the members of the 'old Union' over the last 16 years.

So Mario Draghi, quite unintentionally, has shown one of the problems of the Community, which is the unequal treatment of old and new members. However, the report itself seems to be an accurate diagnosis of the symptoms of the disease consuming the Community in the economic field. Mario Draghi described it as: "an existential challenge for the Union".

Those present at the press conference heard the former ECB chief say: "Now we can no longer ignore the problems. Conditions have changed. World trade has declined (...) China has become less open to us, and in fact they are competing with us in every way on global markets. We have lost our main supplier of cheap energy, Russia," he said. To this list of challenges, the Italian added the need to start defense preparations to face any military threat and the deepening demographic crisis.

But the most significant thing about his speech was that finally, at the EU summits, the most senior people in Brussels were saying openly - what ordinary citizens have been feeling for a long time - that the community is slowly but steadily sinking. And instead of diagnosing the problems and solving them, the politicians and officials in Brussels, as well as the ruling elites in the Union's largest countries, have persistently tried to keep quiet about them. That is why it is so important when everyone could hear from the mouth of the former head of the ECB that without restoring their economic competitiveness, the countries of the Union: "will not be able to be a leader in new technologies, a model of climate protection and an independent actor on the world stage."

In Draghi's report, the diagnoses he announced at the conference have been deepened and documented in detail. Thanks to them, a picture of the Union's greatest weaknesses emerges. For example, it lacks large companies capable of competing with Chinese and American giants, especially in key industries for development. The report stresses that: "Only 4 of the 50 most important technology companies in the world are European." Although, when we prepared the graph you see on the screen for you, it turned out that there are currently not even 4 EU companies in the top 50 in terms of market capitalisation, but only 3. The whole list is dominated by US companies, which we have included in the picture only 10, out of 36 in the top 50 list.

The picture clearly shows that Europe has largely missed out on the digital revolution, led by the Internet, and has therefore missed out on the productivity gains associated with this change.

The Union's technological backwardness and its lack of companies capable of bridging the innovation gap that already separates it from the United States and China are now being exacerbated by a demographic crisis. The report states that: "The labor force is projected to shrink by nearly 2 million workers per year through 2040. We will have to rely more on productivity to drive growth."

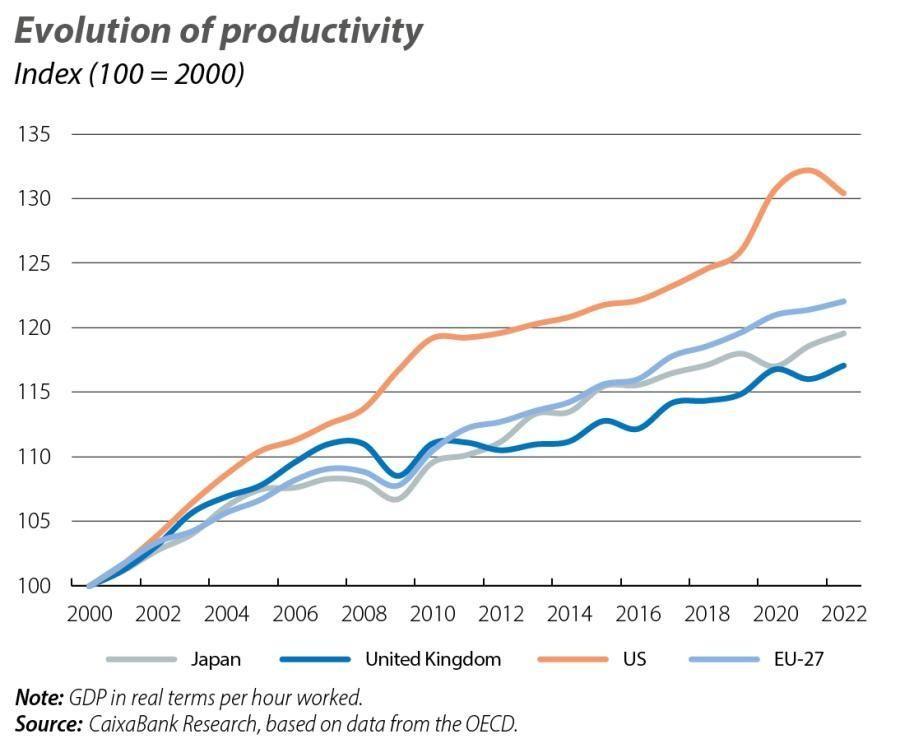

Meanwhile, productivity, or the labor productivity index, in the EU is already "in negative territory" compared to the United States.

"If the EU were to maintain its average productivity growth rate since 2015, it would only be enough to keep GDP constant until 2050" - The Draghi report warns. It warns that if this indicator does not improve, the Community's GDP will start to shrink.

Meanwhile, labor productivity is closely linked to innovation and the creation of new technologies. This is proving very difficult in Europe because, as the report points out, the largest companies "specialize in mature technologies with limited potential for breakthroughs". They therefore spend 270 billion euros less on development research than their US competitors. In general, Europe is still dominated economically by car companies founded in the 20th century, while across the Atlantic it is dominated by companies founded in the early 21st century, in the era of the Internet revolution. To make matters worse, the Union lacks capital interested in promoting change.

"As a result, many European entrepreneurs prefer to seek funding from US venture capitalists and expand in the US market." - Draghi's report says. That's why more than 30 percent of startups founded in the EU, known as "unicorns" (those over $1 billion in value), have moved out of Europe, mainly to the US.

This looks bad at a time when the next technological revolution has begun, driven by the accelerating development of advanced artificial intelligence models. According to the report's thesis, Europe must rise to this challenge because: "it cannot afford to remain in the 'mediocre technologies and industries' of the last century." Again, this is proving very difficult due to the deterioration in the quality of training of technical personnel capable of participating creatively in the AI revolution. Moreover, instead of creating favorable conditions for the development of AI, the Union is primarily concerned with regulating the nascent market and stifling its growth. The Americans and Chinese are doing the exact opposite, opening the gates wide and encouraging its development.

As if the problems weren't enough, the plans to decarbonize the economies of the EU countries don't go hand in hand with increasing their competitiveness and development. In general, this problem is highlighted very lightly in the report, and later in the document, decarbonization itself is described as one of the greatest opportunities for the future.

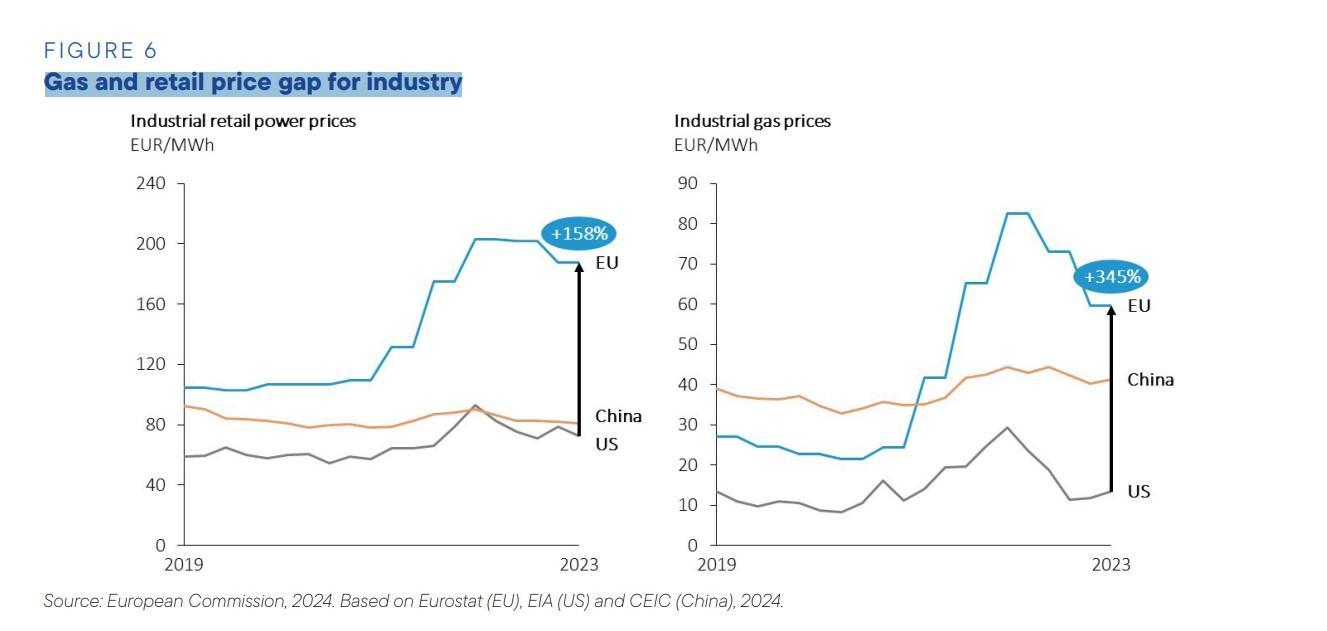

But in terms of the present, the document highlights that although energy prices have come down significantly from peak levels, companies in the EU still have to pay 2-3 times more for electricity than in the US. Natural gas prices are even 4-5 times higher in Europe.

Za: The future of European competitiveness _ A competitiveness strategy for Europe.pdf

This situation not only affects the competitiveness of European industry, but also generates high taxes, rents and charges. It hurts citizens more and more.

"Over the medium term, decarbonisation will help shift power generation towards secure, low-cost clean energy sources. But fossil fuels will continue to play a central role in energy pricing at least for the remainder of this decade. Without a plan to transfer the benefits of decarbonisation to end-users, energy prices will continue to weigh on growth" the Draghi report diagnoses. Interestingly, the report also claims that the European Union remains a world leader in "clean technologies" such as wind turbines, electrolysers and low-carbon fuels. However, it acknowledges that competition from China is becoming increasingly fierce. And companies from the Middle Kingdom can count on the Chinese government's industrial policy and support through permanent subsidies.

According to the report: " Increasing reliance on China may offer the cheapest and most efficient route to meeting our decarbonisation targets. But China’s state-sponsored competition also represents a threat to our productive clean tech and automotive industries." This state of affairs presents the community with the dilemma of what should come first - the fight against global warming, or the economic development of EU countries. The report avoids this problem with vague slogans. They read as follows: "Decarbonisation must happen for the sake of our planet. But for it also to become a source of growth for Europe, we will need a joint plan spanning industries that produce energy and those that enable decarbonisation such as clean tech and automotives." Sounds as nice as it is unspecific.

Here, Draghi's report moves smoothly from the diagnosis of the main economic malaise of the Union to the lurking dangers that may intensify in the future. The list of dangers begins with the growing risk of geopolitical upheaval. Wars and conflicts weaken the willingness to make long-term investments, stifle international trade and can ultimately disrupt supply chains. Europe is particularly vulnerable to the consequences of such events. All the more so because of its resource poverty. This is because it has to import both fossil fuels and rare earth metals, which are necessary for the production of high-tech products. The same goes for lithium, which is needed for the production of lithium-ion batteries.

"We are also hugely reliant on imports of digital technology. For chips production, 75-90% of global wafer fabrication capacity is in Asia." - The report stressed. This means that the European economy would now face a catastrophe if communication routes are cut off and supply chains are disrupted. The Union must therefore invest in their integrity, as well as in access to strategic raw materials and the development of its own military capabilities. This means huge expenditure at a time when resources are limited and needed elsewhere. This, in turn, poses a dilemma for the Community as to whether development or security should take precedence. And how to ensure that both are provided.

In the area of strengthening the armed forces, there is a need for concerted efforts and closer cooperation. A very telling statistic is that the Union as a whole spends a total of around EUR 240 billion a year on defense. This includes arms purchases, salary payments, living costs and research and development. Only the United States spends more in this area. And yet Europe seems to be completely defenceless.

Za: https://www.statista.com/statistics/1395834/eu-military-expenditure-by-country/

The Old Continent's position in the world is also weakened by the fragmentation of the capital market, excessive bureaucratic regulations and a lack of coordination in the economic sphere with regard to countries competing with the EU.

If we add up all these weaknesses and compare them with the economic situation of the United States and China, the overall picture for the Old Continent becomes increasingly bleak. However, one should not forget the enormous potential that the countries that make up the European Union still have. Economic, technological and demographic.

In general, Europe has enough tools in its hands to overcome the threats and once again amaze the world with its wealth and development. Its biggest problem is making wrong political decisions, not keeping up with changes and not being able to implement strategies that are fundamentally correct, but as it turns out after some time - remain only on paper.

To see this, it is necessary to take a little trip into the past to trace two very symptomatic processes of great change. One of them concerns the world superpower, which de facto consists of several state organisms and which, at its own will, has destroyed its chances of maintaining its previously achieved global economic and political dominance. The second of the great transformation processes will relate to the last quarter century of the European Union.

Let's start with the empire that lost at its own request, namely Great Britain.

Empire at the peak of its power

We talked about the British last time, but this is such a vivid and close enough example of decline that it is worth elaborating.

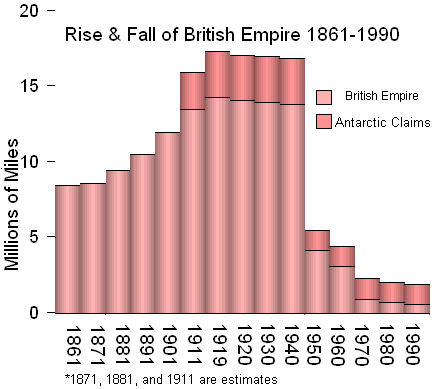

The point at which Britain was at the height of its power can be taken as 1850, although, paradoxically, since then it has managed to more than double the size of its empire and still subjugate new territories.

Thus, at the height of its territorial expansion in 1920, it covered an area of more than 21 million square kilometers, inhabited by half a billion people. They lived in a complex system of some 120 dominions, colonies, and mandated territories. All were nominally subjects of the monarch, who resided at Buckingham Palace in London.

Never before or since has an empire as large and influential existed in the history of mankind.

Able to rule the entire globe for over a century, shaping an order, set by prime ministers who reside in London in an ordinary building at 10 Downing Street.

The uniqueness of the British Empire is best illustrated by the fact that in 1850, Britain alone had only 1.8 percent of the world's population and its land area was only about 0.16 percent of the world's land area. This "handful" ruled over a quarter of the world's land area and subjugated about a third of the world's population at that time.

From the mid-19th century, however, the empire rolled down an ever-accelerating slope, even as it continued to expand its territory. It also found itself among the winners of two world wars. After that, it simply disintegrated, as Britain lacked the strength to continue holding it together.

If you are looking for an answer to the question of how this happened, focus on two terms: technological revolutions and competitiveness. Britain owed its stunning success to the technologies that emerged during the first industrial revolution and the devices that were built with them, most notably the steam engine. An relatively small island on the edge of Europe became the world's first industrial superpower, and was able to use this potential to develop its economic and military power. As a result, by 1850 Britain could boast that its mines guaranteed 75 percent of the world's coal production, while half of the world's textiles and steel came from British factories. The same was true of all industrial production. The British Empire held half the world's industry in its hands, and it was extremely modern. What a power Britain was at that time was brilliantly demonstrated in 1851 by the Great Exhibition of the Industry of All Nations.1.

It was held in the Crystal Palace, which was half a kilometer long and 43 meters high, built at lightning speed in the grounds of Hyde Park. It was a thoroughly modern structure, based on iron bars interspersed with panes of glass. The Crystal Palace alone, with its vastness and modernity, conveyed the grandeur of the empire to the 6 million tourists who came to the exhibition from all over Europe.

Za:https://en.wikipedia.org/wiki/The_Crystal_Palace#/media/File:Crystal_Palace_General_view_from_Water_Temple.jpg

Inside, according to reports in the European press, there was a "battle of nations" in the field of modernity. No less than 6146 of the nearly 13,000 stands were occupied by British industries from all over the Empire. Industrialists from Prussia, and other German states, who came second in this ranking, boasted a much more modest 1,563 stands. These proportions perfectly reflected who dominated the global economy.

But among the more than 6,000 British stands, visitors found nothing to surprise or delight them. The Empire's industries offered things they already knew. On the other hand, two foreign exhibits caused a stir. The first of these stands was prepared by the owner of the Essen metal works, Alfred Krupp. Tourists admired a two-ton solid steel bar of extraordinary hardness and a cannon made from it.

At a time when British companies were still casting bronze cannons, Krupp's innovative design amazed with its strength and rapid firing.

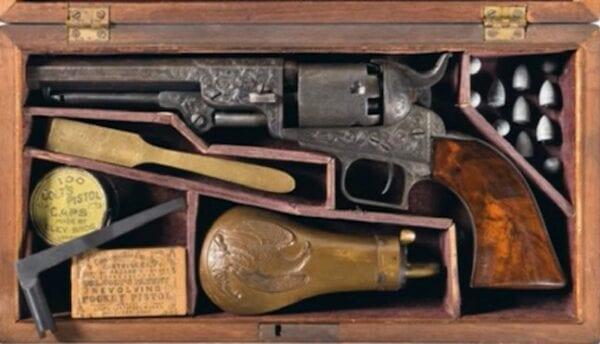

Only Samuel Colt, who came from the United States, aroused the same interest. His factory presented its six-shot revolver. Guns made in England could only fire one shot and had to be reloaded.

Za: https://exhibitcitynews.com/a-tour-of-the-great-exhibition-of-1851/

Colt gave one of its revolvers to Prince Albert, the husband of Queen Victoria, and then set up the first American factory in London. The company soon secured a contract to supply 23,000 revolvers to officers in the British army and navy. Thus, the more innovative Colt began to win over competitors in Britain. Shortly thereafter, Krupp rifles began to make a similar splash.

German steel was also proving to be superior to British steel. Meanwhile, it was a strategic product and an important building material for its time. Steel was used to make: rails, viaducts, bridge spans, building frames. It was used to make the most important components: machines, ships, weapons, etc. And the best steel was offered to the customers in Europe by the Krupp group, thanks to its innovative technologies.

In the years following the Crystal Palace exhibition, the innovative capacity of British industry gradually declined. With it came the loss of the advantage it had held until then.

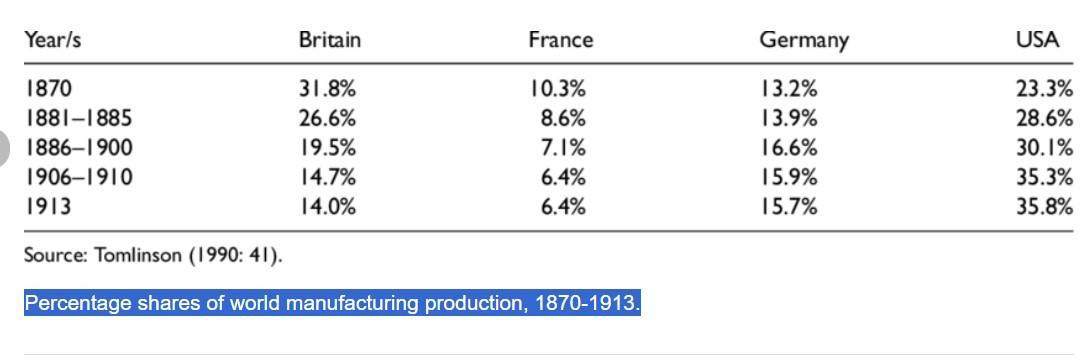

In 1871, Britain was still the world's greatest power, but its industrial output already accounted for only 31.8 percent of the world's total. Closer and closer to the leader in this race was the United States, with a global output of 23.2 percent. After reunification, Germany was in third place with 13.2 percent of the world's output, and France was in fourth place with 10.3 percent.

To maintain its dominance, Britain needed new development impulses. Those generated by the first industrial revolution were already coming to an end. Given the vast financial and human resources and access to world markets that remained in London's hands, turning another technological revolution into an economic success should, in theory, be no problem. What's more, the British had exclusive access to several groundbreaking inventions.

A classic shot in the foot

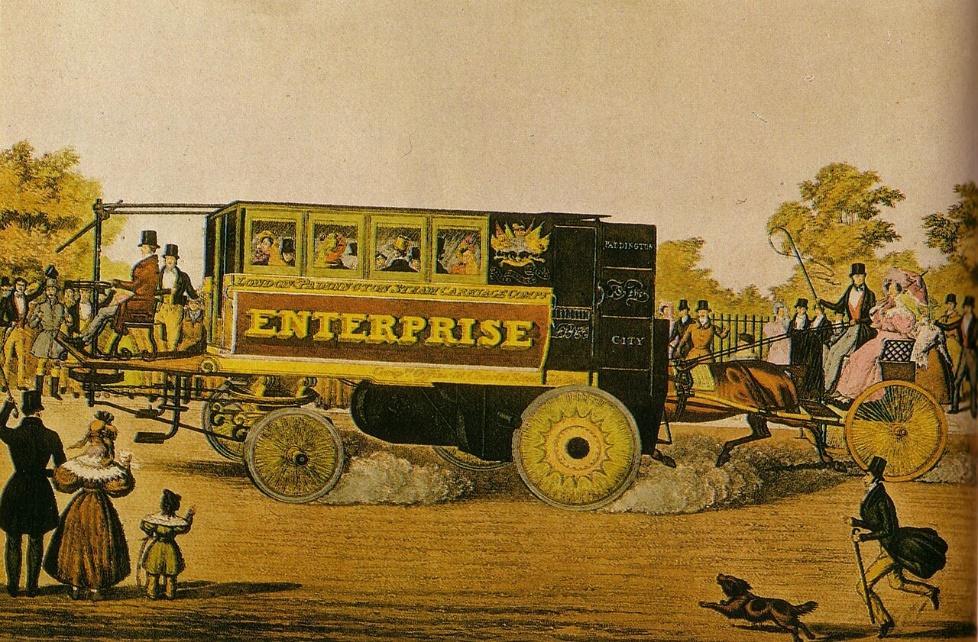

As early as 1827, designer Walter Hancock patented a lightweight steam boiler consisting of several separate chambers. Two years later, he presented a vehicle powered by this boiler. It could carry up to 10 people and their luggage. Over the next decade, freight companies began to spring up in England, using steam omnibuses to transport passengers and goods where locomotives could not. Nowhere else in the world did road transportation based on motor vehicles existed. Nor were profitable companies established to produce them.

Za: https://en.wikipedia.org/wiki/Walter_Hancock#/media/File:Entreprise.JPG

A whole new industry was slowly emerging, based on innovative technologies. Britain was already on the threshold of becoming the home of the automobile in the mid-19th century. At this point, let's recall the part of Draghi's report that refers to the importance of the automotive industry for Europe. In the 20th century, it was the main flywheel of the development of the most modern countries of the old continent. It determined their competitiveness and innovation. In 1850, it was enough for omnibus companies to quietly develop and perfect their vehicles. They actually only had to wait for the appearance of a drive that would be lighter and more useful than the steam engine. And then the British omnibuses would have set off to conquer the world. But that never happened. And why not? Because of regulations.

With the rise of omnibus companies, accusations that the vehicles endangered pedestrians, damaged road surfaces, scared horse-drawn carriages and caused much other damage intensified in the press that appeared in Britain. The media campaign was sponsored by railroads and freight companies that used horse-drawn stagecoaches. They had far greater financial resources than the omnibus manufacturers, who were not yet established in the market.

Politicians therefore sided with the more powerful lobby and its associated newspapers. This resulted in stricter laws regulating the participation of steam omnibuses in traffic. First of all, tolls were introduced for entering cities. Then, in 1861, a law was passed to limit the speed on the roads. When driving through the countryside, omnibuses had to slow down to 10 miles per hour, and through cities to 5 miles per hour.

The speed limit effectively meant that the omnibus was no longer competitive with the horse-drawn stagecoach. And then, politicians and lobbyists came up with another brilliant idea.

In July 1865, Parliament passed the Locomotives Act, which had been drafted by Lord Palmerston's government. It required that each omnibus be operated by three people. One of them had to walk in front of the vehicle, carrying a red flag during the day and a lantern at night.

The law - commonly referred to as the "Red Flag Act" - stated: "A person shall, while a locomotive is in motion, overtake the locomotive on foot by not less than sixty yards, carry a red flag in constant view, and warn riders and drivers of the approach of such locomotives, and signal the driver when it is necessary to stop, and assist horses and horse-drawn vehicles passing by."

Violation of these regulations was punishable by a fine of £10 (which would be about £1,000 today). The new law took away the main strengths of the omnibus, which were speed and mobility. So when it came into force, all the companies that used them went bankrupt.

Za: https://images-cdn.bridgemanimages.com/api/1.0/image/600wm.LAL.0055620.7055475/262321.jpg

A dozen months after the British government prevented the birth of an automobile industry in the country, Nicolaus August Otto unveiled his internal combustion engine at the Paris World Exhibition in April 1867. Very imperfect, but lighter than a steam engine. It was also powered by gasoline, which was much easier to use and more efficient than coal.

Thanks to the internal combustion engine, road vehicles could weigh much less and proved to be more mobile than steam engines. However, it took some time from the birth of the combustion engine to its use in automobiles due to the lack of suitable technological solutions in Germany. Designers had to overcome the same challenges that Hancock and other builders of steam buses had faced. Finally, in October 1885, Karl Benz unveiled his first vehicle. Much smaller and more primitive than the English, but powered by an internal combustion engine and free of legal restrictions. In time, it was Germany that became the home of the automobile, and it is this industry that has become the foundation of the German economy to this day.

Immediately after the Germans, the Americans began to reap the benefits of the new technological revolution. There, Henry Ford orchestrated the additional developmental impulse that transformed the entire industry. It was enough to invent the assembly line and mass production, after which no one could keep up with the economic development of the USA in the first decades of the 20th century.

Meanwhile, the British were able to enjoy their locomotives, stagecoaches and carriages for the entire second half of the 19th century.

Equally easy the United Kingdom gave up on the other disruptive technology of the time. Namely, the converter designed by Henry Bessemer in 1856 to melt steel, one of the most important materials of the 19th century.

We also talked about it extensively in the episode on American reindustrialization:

"Thomas' discovery was of no interest to any British steelworks. Meanwhile, it turned out that Bessemer had bought back the patent for his invention from Alexander Holley, a locomotive designer and founder of the American Society of Engineers. An emigrant from Scotland, Andrew Carnegie, entered into a partnership with him for the valuation. He brought together a group of businessmen who were willing to put up funds to create a "metallurgical concern".

When the British economy was losing its competitiveness as it had already fallen far behind the American and German economies in the area of innovation, the British government did much to weaken domestic industry.

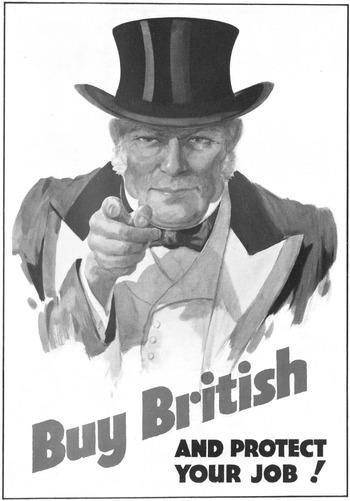

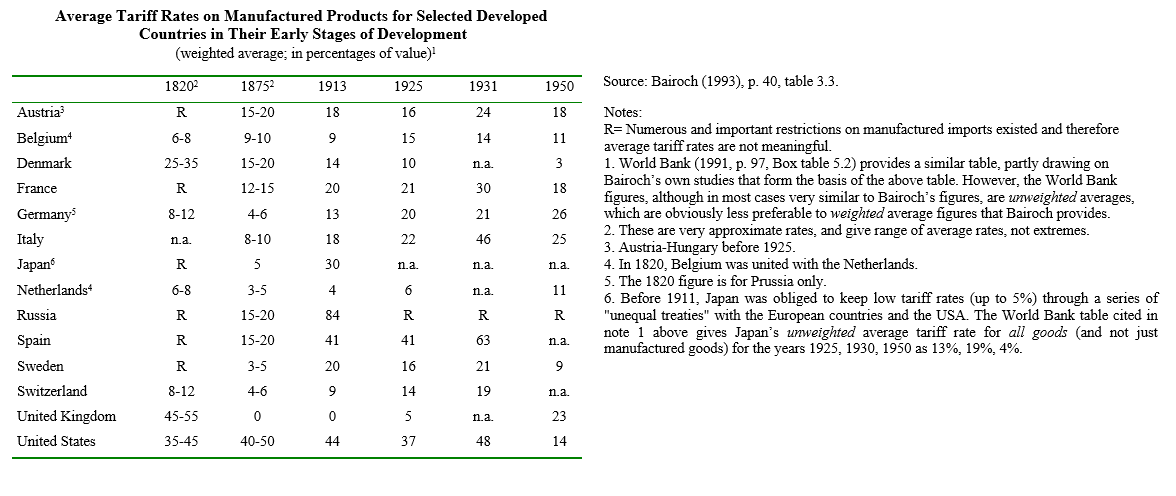

Lo and behold, for more than 50 years, Britain forced country after country to remove tariff barriers to promote free trade. It also abandoned the use of tariffs itself. This opened up new markets for British manufactured goods. Their quantity and cheapness meant that wherever they went, they effectively stifled the development of local industry. And when a country tried to protest, Royal Navy ships would appear and the desire to protest would pass.

In the second half of the 19th century, however, the situation changed radically. Industrial production grew rapidly in Germany and the United States. At the same time, both superpowers raised tariff barriers to protect their markets and domestic producers. Both were also too powerful for London to use the "canon policy" against them. To avoid destroying free trade, Lord Salisbury's government pushed the Merchandise Marks Act through Parliament in 1887.

It mandated that all goods from Germany sold within the British Empire be marked "Made in Germany. Salisbury thought, that British products were so superior that the consumer, who now knew what he was buying, would always choose them. He was sorely mistaken, for he did not realize how technologically backward the British economy already was. Consumers preferred to buy what was German because it was simply better.

Za: https://static.cambridge.org/binary/version/id/urn:cambridge.org:id:binary-alt:20180517072754-88763-mediumThumb-03267fig5_1.jpg?pub-status=live

The commitment to free trade in the United Kingdom proved so formidable that the critical voices of individuals such as the influential journalist Ernest Edwin Williams remained completely isolated. In 1896 he published a series of articles on protectionism, later collected in a book entitled. "Made in Germany." In it, he warned that: "We are now losing control of our colonies and dependencies, which are gradually falling into German hands. German goods are going to India, Canada, Australia on the same terms as English goods." Williams thus demanded: "To the extent that a foreign country excludes our goods from its markets, to that extent should we penalize its goods in our markets." Successive British governments, however, preferred to adhere to the free trade doctrine, even as other powers turned away from it.

For example, when Britain maintained zero tariffs on foreign manufactured goods, Germany raised them to 13 percent of the pre-World War I value of goods. This was still a very liberal policy compared to the US. In fact, U.S. tariffs had reached 44 percent, and the Americans were doing everything they could to become the world's greatest industrial superpower. They achieved their goal in phenomenal style. Suffice it to say that in 1913 the U.S. produced 35.8 percent of the world's industrial output, Germany came in second with 15.7 percent, and Great Britain was a distant third with 14 percent.

The decline in economic importance meant that the time of the Empire's disintegration was fast approaching. But it proved to be so well organized that only two world wars accelerated the process, leading to the final end of the masterpiece of the inhabitants of the small island across the English Channel.

The powerhouse of innovation

Now let’s to go on to trace the second of the symptomatic processes of great change. To do so, one must jump forward a hundred years, to the beginning of the 21st century. As in the case of the British Empire, we will see a huge political and economic creation that is neither a completely unified state nor a unified economic organism, although it is sometimes perceived as such. We are talking, of course, about the European Union, which is already too integrated to be considered just a loose association of independent states, but is also very far from being able to function as if it were a single state. Similar words could be used to describe its economy. The Union is thus as unusual a collection of political and economic entities as the British Empire once was. While there are more differences than similarities, it is nonetheless fascinating to trace how the European Community began to lose its future as it tried to win it.

Interestingly, the Union's political elites seemed much more sensible than the British of a century and a half ago, and not at all intent on repeating old mistakes. The decisions taken at the turn of the 20th and 21st centuries clearly showed that they recognized the importance of innovation and competitiveness. They recognized them as crucial to the future of Europe as a whole. The best evidence of this is the so-called Lisbon Strategy, adopted by the European Council in March 2000.

At the Lisbon Summit, the Heads of State and Government defined their goal as follows ” The European Union should become the most competitive and dynamic knowledge–based economy in the world, capable of sustainable development, creating greater numbers of better jobs, and developing greater social cohesion." the European Parliament said in a communiqué at the time.

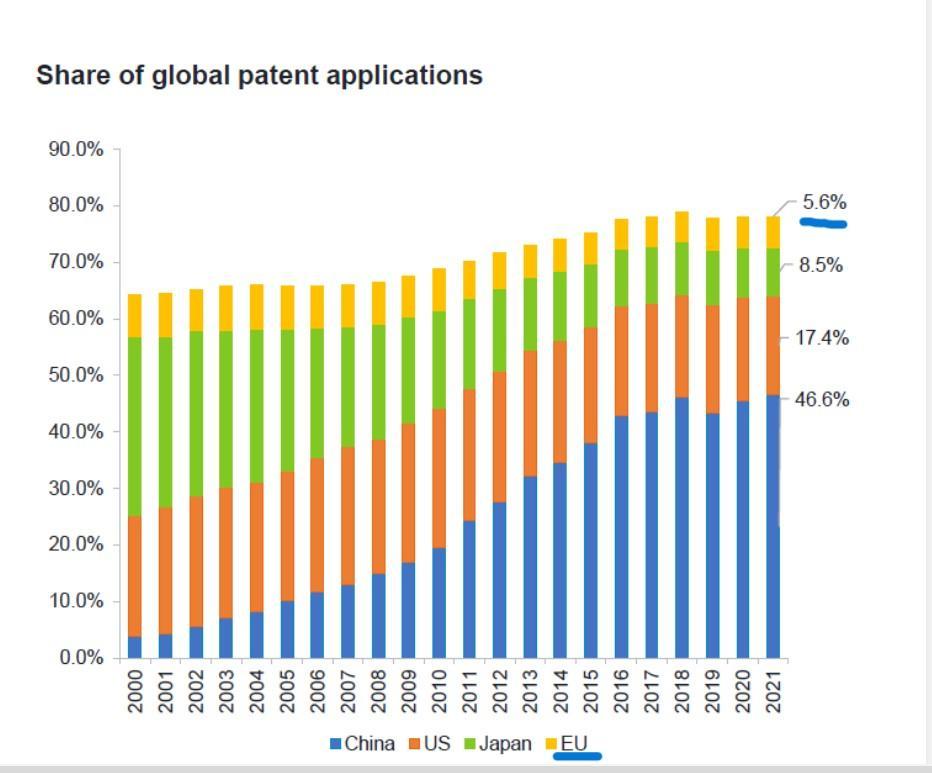

Yet, over the next five years, despite spending and new directives from the European Commission, instead of overtaking the United States and China in the field of innovation, the European Union fell further and further behind. This process can be traced in the summary reports of the World Intellectual Property Organization (WIPO).

During the implementation of the Lisbon Strategy, the number of new patent applications to the European Patent Office (EPO) peaked in 2006. At that time, just over 57,000 new applications were registered, after which the number fell for four consecutive years to 54,000 in 2010. In that year, more than 490,000 patent applications were filed in the United States, 391,000 in China and 344,000 in Japan.

According to WIPO statistics, the EU economy was already six or even ten times less innovative than its largest competitors in terms of creating new technologies. By the way, this situation has not changed to this day. In 2021, more than 1.5 million patent applications were accepted in China, 591,000 in the US, 289,000 in Japan, 237,000 in South Korea, and barely 188,000 were filed with the European Patent Office.

The fact that all the countries of the Union combined were overtaken even by tiny South Korea is the best evidence of the overall regression.

That said, it was recognized in Brussels as early as 2005 that the Lisbon Strategy wasn't working. Former Dutch Prime Minister Wim Kok was appointed chairman of a group of experts tasked with reviewing the Lisbon Strategy. His report was somewhat reminiscent of the Draghi report in that it bluntly stated - that it's bad and something needs to be done about it. So the European Commission proposed a "new start for the Lisbon Strategy", focusing the European Union's efforts on two main tasks - ensuring stronger, sustainable economic growth and creating more and better-paid jobs.

In a special summary, it was enumerated that the main tasks of the new strategy would be to promote knowledge and innovation, to improve the regulatory framework, with the removal of obstacles to the flow of capital.

In the years that followed, some things succeeded, others did not. On the other hand, in the area of the next technological revolution, successes were recorded and profited from: the United States, China, South Korea, other Far Eastern "tigers," and even India. As personal computers and laptops (with their cutting-edge software), the Internet, smartphones, social networks, etc. became widespread, the gigantic profits generated by these changes flowed to U.S. companies such as Microsoft, Apple, Google, and Amazon. They were soon joined by Chinese companies like Alibaba and Huawei, as well as South Korea's Samsung and LG.

At this point, let's recall the Draghi's report. Europe has largely missed the digital revolution. Instead, innovation efforts have been replaced by bureaucratic and regulatory efforts. Just as Britain began to feel the effects of the "Red Flag Act" not a few years after its introduction, but three decades later. Same happens in the case of Europe. Today the EU is stifling AI development, and that will be felt for decades to come.

The problem is that neither the Union as a whole, nor the countries that make it up, have proven capable of implementing the much-needed changes. The diagnosis was correct - the patient is sick, the disease was aptly named, but the therapy proved ineffective.

As Jacek Piotrowski describes in his study "The Lisbon Strategy - Reasons for Failure", "the main reasons for the unsatisfactory results were the lack of focus, non-transparency of actions and inefficiency of implementation, as well as the failure to involve the business community in the development and implementation of the strategy. “

When these seemingly accurate conclusions were reached, the European Council put forward the next paper. This time it was the vague and thus uncontroversial "Europe 2020" strategy for the next decade. When it was in force, ideas for new "flywheels" for the EU economy were again to be rebuilding competitiveness and innovation, but this time with climate policy at the forefront.

Climate powerhouse

While the Lisbon Strategy was still in force, EU heads of state and government agreed at the European Council summit on December 12, 2008, to adopt a climate and energy package. They instructed their countries to achieve the "3x20" target by 2020, i.e. to reduce CO2 emissions by 20%, to increase energy efficiency by the same amount, and to meet at least 20% of market demand with electricity from renewable energy sources. The European Commission was tasked with drafting directives specifying the changes that needed to be made in order to achieve the strategic goal.

At the same time, fundamental changes were taking place in the European Union under the aegis of Chancellor Angela Merkel. The ratification process of the Lisbon Treaty was completed, welding the EU into a political organism in which the most important functions in the decision-making and executive process began to be performed by the European Commission. The list of areas in which member states could exercise their veto rights was narrowed down to issues related primarily to foreign and security policy. Unanimity was replaced by qualified majority voting in the European Council and the Council of the EU. It now decides on the vast majority of EU policies, including decisions related to climate change, digital regulation or the single market, and on migration issues.

In practice, these changes have meant a much greater ability to enforce on member states the implementation of both decisions adopted by the European Council and approved by the European Parliament, and the subsequent implementation of the European Commission directives that follow them.

Another step towards a new development strategy for the Union was the UN Climate Conference in Paris. Thanks to the determination of US President Barack Obama, with the support of Germany and France, in December 2015 as many as 195 countries concluded an agreement to radically reduce greenhouse gas emissions. The document was later quickly ratified by the European Union.

All countries were to participate in the process of reducing emissions of carbon dioxide and other greenhouse gases to save the planet. This meant using brand-new equipment based on innovative technologies, converting energy systems to zero emissions, carrying out a revolution in road transport, moving away from fossil fuels, etc. It was a "window of opportunity" for those who would produce and provide the tools needed to implement it, a window worth every effort because it generates profits in the trillions of euros.

In December 2019, the European Commission presented while the European Council approved a new strategy called the "European Green Deal." It included redirecting the maximum possible amount of EU resources to investments related to the "green transition."

"The European Green Deal sets out how to make Europe the first climate-neutral continent by 2050, boosting the economy, improving people's health and quality of life, caring for nature and leaving no one behind" the European Commission said in press release at the time.

The Union's long-term budget for 2021-2027 has earmarked a third of its 1.8 trillion euros for this purpose. A temporary NextGenerationEU fund was also added, with €800 billion in joint borrowing by EU countries. It was then decided that the so-called "milestones" included in the national recovery plans should largely concern energy transition and protection measures for the poorest sections of society.

"The EU's long-term budget, combined with the NextGenerationEU (NGEU), a temporary instrument to stimulate economic recovery, is the largest package of measures ever funded in Europe. A total of €2.018 trillion in current prices," the European Commission boasted on its website in 2021 about the financial instrument designed as a "flywheel" for the Great Transformation.

Two basic goals were set: to restore the strength of the EU economy while reducing net greenhouse gas emissions by at least 55 percent from 1990 levels by 2030, and to make the EU climate neutral by 2050.

The "roadmap" leading to these goals is outlined in a package of EC directives called "Fit for 55", the key measures of which were endorsed by the European Council in April 2023.

Yet by then, Europe was losing the economic race not only to the United States but also to China. In its climate policy, the Community also lost the support of the United States, which was ruled by Donald Trump. The list of problems did not end there. The old continent was plagued by migratory and demographic crises, later the COVID-19 pandemic arrived, immediately followed by an energy crisis and a major war in the East of the continent. Russia, trying to force NATO to accept that Ukraine should return to its sphere of influence, first used the fossil fuels as a weapon, even before the armed invasion, drove up the prices of natural gas and oil, with a strong impact on the EU economies, led by Germany.

And thus there was a growing number of circumstances that threatened to push the community into an even faster downward spiral on the economic front. Draghi's report only confirmed this.

Real threat of Union breakup.

To summarize the effectiveness of the "European Green Deal" strategy on the economic front, one need only look at the key economic sectors that were supposed to be the "flywheels" of the Union's great transformation.

In the case of the automotive industry, which remains crucial to the Community's prosperity, the latest news is either bad or catastrophic. In mid-September, the European automobile manufacturers, grouped in the ACEA organization, which represents the 15 largest European carmakers, called on the EU institutions to propose urgent aid measures. They say they will not be financially able to meet the new CO2 reduction targets for cars and light trucks. These targets will come into force in 2025.

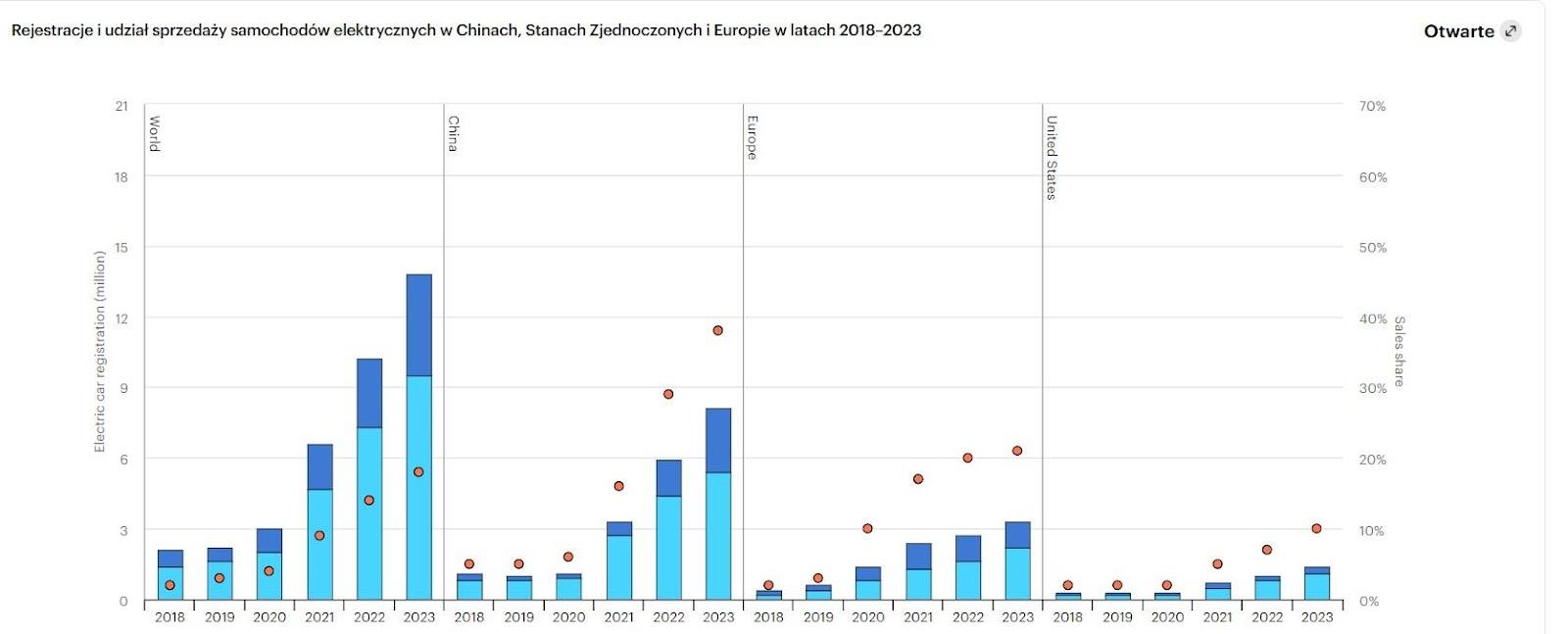

The production of vehicles with internal combustion engines could become completely unprofitable in the EU, especially since car sales are still about 18 percent lower than before the pandemic. At the same time, sales of electric vehicles are growing in the Union, but still much slower than in China.

Za: https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

"The current regulations do not take into account the profound changes in the geopolitical and economic climate in recent years, and the law's inherent inability to adapt to real world events further weakens the competitiveness of the (automotive) sector," - warns the ACEA on its website.

This is borne out by the huge wave of job cuts and car plant closures that is beginning to sweep across Europe. The Volkswagen Group plans to lay off up to 30,000 workers in Germany. At the same time, it is considering increasing production capacity at its factories in China.

In the Italian factories of the Franco-Italian-American Stellantis group, a general strike is being prepared for October 18, 2024, in response to the announcement of job cuts at the Fiat plant in Turin, among others. There are fears that this could spread to France, where the number of jobs in the car industry has already fallen from 289,000 to 175,000 in recent years. And emerging media speculation is that layoffs of up to 90,000 workers are imminent! And so we might expect a wave of strikes and protests to sweep across Europe, like the framers revolt of spring 2024.

What's happening to the automotive industry in the EU has already affected companies producing photovoltaic panels and wind turbines, which have been literally wiped out by Chinese competition. The production of electric batteries is also about 70 percent in the hands of companies from the Middle Kingdom (see our episode on that) They are the ones who benefit from the "European Green Deal" by eliminating local competition.

The EU has thus become, as planned, a key force in the world - promoting and even forcing a reduction in greenhouse gas emissions and a shift away from fossil fuels. The EU has its "Fit for 55". But China has BYD, SAIC, Geely or CALT and many other giant corporations, and a government that provides them with numerous subsidies and tax breaks. So it is the community that has become a market and an area of expansion for them.

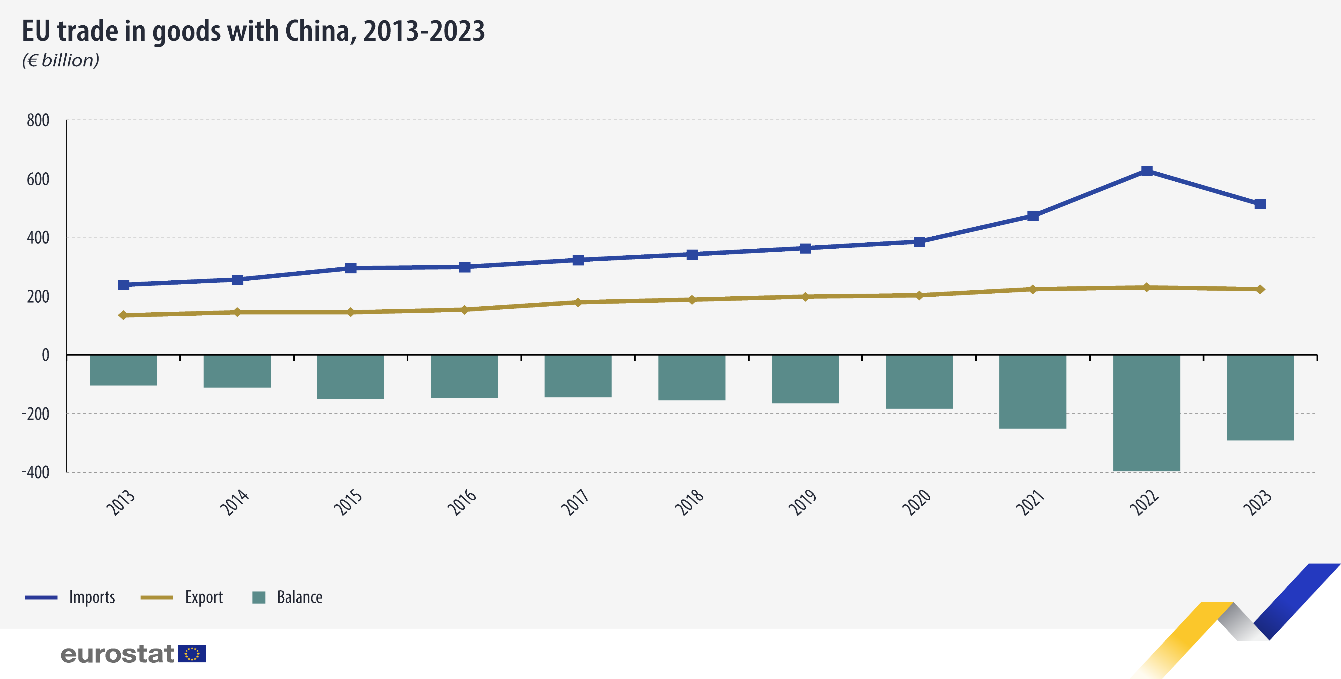

At the same time, the Chinese market is becoming more and more closed to European products. This, in turn, leads to a gigantic trade imbalance. Between 2013 and 2023, the EU's trade deficit in goods with China went from 104 billion euros in 2013 to 397 billion euros in 2022, the highest of the decade. There was some improvement in 2023, when, according to Eurostat data, the imbalance went down to 291 billion euros, but still it means that 300 billions euros fly away from Europe, yearly!

Such an "improvement," is too little to herald a reversal of the trend, which in simple terms means a successive outflow of wealth from Europe to the Middle Kingdom. Just as the wealth of the British Empire once flowed slowly to rival powers that maintained high tariffs.

At the same time - as Draghi's report mentions - successful start-ups that create new technologies that offer a chance to increase the competitiveness of the economies of EU countries are moving to America.

In general, this is the current situation of the European Union, squeezed between the rapidly growing China and the United States, which is fighting to maintain its economic primacy. It's already clear that a repeat of the Lisbon Strategy debacle is in the pipeline, and we even have a report analogous to Wim Kok's in 2005. The problem is that this time the consequences of failure could be far more dramatic, even threatening the very existence of the European Union. For the economic collapse will generate such great social tensions within and conflicts between member states that they could tear the entire community apart from within. It is therefore necessary to increase the competitiveness and innovation of the EU economy as soon as possible. The whole problem is - how to do it?

Prescriptions without key diagnosis

Even before the Draghi report was published in February, the heads of the EU finance ministries met in Ghent to discuss the problems weakening the EU economy. In their view, the main reason for the loss of competitiveness is the fact that, compared to the United States, the European Union is actually a fragmented bloc of countries, not a community. This bloc suffers from chronic underinvestment, a rapidly aging population, and, despite 31 years of the single market, it has a major problem with the free movement of labor, capital, and goods. In general, the ruling elites in Brussels think and talk about a common European economy, but such an economy is far from being born. Moreover, instead of generating investment, the EU is losing capital (some 330 billion euros last year) as Europeans place their savings abroad, especially in the much larger US stock market.

The ministers in Ghent therefore proposed tearing down the remaining barriers between member states and transforming the Union into a true single market.

"We need to ensure that companies, especially smaller ones that want to grow faster, have access to adequate financing," said Paschal Donohoe, chairman of the Eurogroup of EU finance ministers, in Ghent.

However, the creation of a common EU capital market is being blocked by Berlin, which fears the loss of Germany's advantage in the EU due to its financial resources. According to the Draghi report, three other major areas are more important. Namely (quote)

- Closing the innovation gap that has developed between the EU and the US and China;

- Creating a unified plan for decarbonization and competitiveness;

- Improving security and reducing dependence on external suppliers of key raw materials and technologies.

The achievement of these tasks is expected to restore the Union's competitiveness and economic growth. How this should be achieved is already discussed in the detailed part of the document, which contains recommendations that constitute a "road map" for the European Commission. So that the Commission can translate them into directives.

This raises the question of where the funds will come from to achieve such ambitious goals at a time when economic growth is faltering, industrial production and capital are leaving the old continent one by one, and the countries of the south of the Union are drowning in debt. Draghi's report sees salvation in the EU debt issuance program (analogous to the one that made it possible to finance the Recovery and Resilience Plans). It would allow 750-800 billion euros a year to subsidize the energy transition and support industry. This would make it possible to withstand Chinese competition.

The problem is that that the European Commission's previous joint borrowing for the Recovery Plans is itself a festival of EU self-destruction. Hardly anyone remembers that this enterprise was supposed to help the Community countries hit by the pandemic to recover. Meanwhile, the Commission has used the whole mechanism as a tool to extend its power over weaker EU countries. The creation of plans and "milestones" got bogged down in procedures, disbursements were and are delayed. In the end, a significant portion of the money is redistributed in ways that have nothing to do with strategic development goals. There is no guarantee that the implementation of Draghi's plan will be any different.

At the same time, Berlin doesn't want to hear anything about further joint debts for the Union. "These ideas are to Germany's detriment, because they mean the risk of greater liability for Germany," Finance Minister Christian Lindner announced in an interview with the FAZ.

The same goes for the "selective protectionism" proposed in the report, which mimics the actions of President Trump, who has ensured that US tariffs on Chinese industrial goods are now six times higher than they were at the beginning of his term. And President Biden has added more of them, including a 100 percent tariff on Chinese electric cars. Similarly, Europe may try to protect its market from Chinese expansion.

But raising tariffs means an analogous response from the other side. Meanwhile, Germany has enjoyed economic growth over the past two decades largely because of free trade and mainly with China. The EU needs protectionism to defend itself, but Berlin can't afford to risk it.

This situation is best illustrated by the conflict over tariffs on Chinese electric cars. Berlin has tried everything to block the European Commission's move to impose fixed tariffs on Chinese electric cars and their imports into the Union (in other words, to do what the United States has long done). However, there was a breakthrough in this area when, on October 4, the EC's position was supported in a vote by France and 9 other countries, including Poland. Germany was against, yet won the support of only 4 countries, including Orban's Hungary, while as many as 12 abstained. This was enough to break Berlin's resistance, and the Commission gained the ability to introduce tariffs for five years from the beginning of November 2024, protecting the European car market from Chinese electric cars.

It can therefore be said that the first of the Draghi report's recommendations has begun to be put into practice. However, this promising defensive reflex is not much in the face of the challenges facing the European Union.

Let's look at just one of them, which the report considers crucial: the lack of large companies in Europe that have grown on the basis of disruptive technologies. As of today, they have no chance of being created. And why is well illustrated by the example of the electric car manufacturer Tesla, whose market value is currently estimated at $769 billion - twice as much as Ferrari, Porsche, Mercedes, BMW, Volkswagen and Stellantis combined!

Founded by two inventors, the company was taken over in 2004 by Elon Musk, who initially invested only $6.5 million in the company. After that, he was already pouring millions and then billions, not from his own pocket, but obtained from other investors by issuing shares and enticing that they would bring lavish profits in the future. Until 2018 Tesla was generating losses. But seven years earlier, in his State of the Union address, President Barack Obama promised voters that millions of electric cars would soon be on U.S. roads. He then prepared $2.4 billion worth of tax breaks that mostly benefited Musk. And investors came to believe that the future from Musk and Obama's story was indeed coming. For almost a decade, they kept Tesla alive giving Musk their money. In doing so, they built one of the world's largest companies and developed technologies critical to the energy revolution.

A similar development model can be seen today in the example of ChatGPT developer OpenAI. Its revenue of $3.7 billion in 2024 means that it will inevitably show losses of $5 billion. But so what, since the financial market is delighted with OpenAI and values it at $80 billion, expecting generous profits in the future.

It is impossible to repeat this way of giving birth to a new technological corporation within the borders of the European Union. Capital markets are broken, investors trust visionaries only after they move to the US, and the European Commission makes sure that large monopolies do not appear on domestic markets.

Think of Tesla or the tech giants of Silicon Valley - the Americans can use their federal economic policy to support these companies, whose centers are geographically located in specific clusters - in California, Texas or on the East Coast. The Union could theoretically do the same, but that would mean supporting the most developed regions of the continent at the expense of the poorer ones, and the whole concept of the Union is based on the elimination of inequalities. The degree of internal confidence also plays a key role. Arkansas, for example, is not worried about being dominated by Texas, while Greece and Poland are worried about Germany dominating and taking over European politics.

Other points in Draghi's report are quite similar. They sound reasonable, and sometimes even excellent, until one juxtaposes them with the daily life of the EU.

At the same time, the seemingly simplest postulate - tightening political integration by abolishing the principle of unanimity in recent areas such as foreign policy - offers nothing. The eventual domination of the Community by the largest states does nothing to increase the competitiveness of its economy and its innovation. This is all the more true in view of the aggravation of the conflict between Paris and Berlin, where France, following the example of the United States, wants to defend its industry with tariffs and Germany with free trade.

Therefore, the biggest weakness of the Draghi report is its failure to take these realities into account and its lack of a key diagnosis.

Namely, it does not answer the vexed question - why, with the tightening of integration since the beginning of the 21st century, the economies of the Community countries (because the common economy of the EU is still a slogan and a statistical entity, not a reality) have gradually lost their competitiveness. After all, they used to be able to keep up with the economies of the United States and Japan. Why have all the great strategies, although correct in their assumptions, turned out to be impossible to implement? What makes the Union behave as if it had a self-destruct gene built into its DNA code that could bring about its disintegration through economic collapse? Just as the British Empire disintegrated when its economy proved too outdated and uncompetitive with the economies of other powers. The answer to these questions would provide a chance to find the right way to change the Union so that it gains the confidence to survive times of great change. Will that answer come? We don't know.

Sources:

- https://www.youtube.com/watch?v=bFG6U5rgLNI

- https://www.politico.eu/article/emmanuel-macron-france-europe-competition-united-states-china-climate-change-defense-security/

- https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=EU-US-CN

- https://www.youtube.com/watch?v=dVNna0erkFM

- https://commission.europa.eu/document/download/c601b283-d00c-4866-9122-5feaea950d5e_en?

- https://www.money.pl/gospodarka/smutek-i-wstyd-ekonomisci-o-luce-w-glosnym-raporcie-draghiego-7072920861883328a.html

- https://www.youtube.com/watch?v=dVNna0erkFM

- https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en?filename=The%20future%20of%20European%20competitiveness%20_%20A%20competitiveness%20strategy%20for%20Europe.pdf

- https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en?filename=The%20future%20of%20European%20competitiveness%20_%20A%20competitiveness%20strategy%20for%20Europe.pdf

- https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en?filename=The%20future%20of%20European%20competitiveness%20_%20A%20competitiveness%20strategy%20for%20Europe.pdf

- https://en.irefeurope.org/publications/online-articles/article/eu-ai-act-how-stricter-regulations-could-hamper-europes-ai-innovation/

- https://www.statista.com/statistics/1395834/eu-military-expenditure-by-country/

- https://www.britannica.com/place/British-Empire

- https://faculty.econ.ucdavis.edu/faculty/gclark/ecn110b/readings/ecn110b-chapter2-2005.pdf

- https://en.wikipedia.org/wiki/Great_Exhibition

- https://en.wikipedia.org/wiki/The_Crystal_Palace

- https://exhibitcitynews.com/a-tour-of-the-great-exhibition-of-1851/

- https://www.alamy.com/stock-photo/krupp-artillery.html?sortBy=relevant

- https://en.wikipedia.org/wiki/Walter_Hancock

- https://www.atlasobscura.com/articles/steam-buses-horse-carriages-fight

- https://en.wikipedia.org/wiki/Locomotive_Acts

- https://en.wikipedia.org/wiki/Nicolaus_Otto

- https://pl.wikipedia.org/wiki/Carl_Benz

- https://en.wikipedia.org/wiki/Merchandise_Marks_Act_1887

- https://ia801302.us.archive.org/31/items/cu31924031247830/cu31924031247830.pdf

- https://www.europarl.europa.eu/highlights/pl/1001.html

- https://www.wipo.int/edocs/pubdocs/en/wipo_pub_944_2015.pdf

- https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Archive

- https://www.wipo.int/pressroom/en/articles/2011/article_0028.html

- https://www.wipo.int/en/ipfactsandfigures/patents

- https://www.europarl.europa.eu/meetdocs/2009_2014/documents/empl/dv/lisbonstrategybn_/lisbonstrategybn_en.pdf

- https://cejsh.icm.edu.pl/cejsh/element/bwmeta1.element.desklight-60a830f3-390d-4d87-94ea-7ec6db187d01

- https://www.europarl.europa.eu/factsheets/pl/sheet/6/zrodla-i-zakres-prawa-unii-europejskiej

- https://www.consilium.europa.eu/pl/policies/climate-change/paris-agreement/

- https://eur-lex.europa.eu/resource.html?uri=cellar

- https://ec.europa.eu/commission/presscorner/detail/en/ip_19_6691

- https://commission.europa.eu/strategy-and-policy/recovery-plan-europe_pl

- https://www.consilium.europa.eu/pl/press/press-releases/2023/04/25/fit-for-55-council-adopts-key-pieces-of-legislation-delivering-on-2030-climate-targets/

- https://www.acea.auto/press-release/european-auto-industry-calls-for-urgent-action-as-demand-for-evs-declines/

- https://europe.autonews.com/automakers/vw-said-plan-30000-job-losses-germany

- https://www.revolutionpermanente.fr/Licenciements-dans-l-automobile-Il-faut-une-mobilisation-d-ensemble-comme-en-Italie

- https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20240304-2

- https://www.reuters.com/markets/europe-has-uphill-battle-catch-up-with-us-growth-2024-02-26/

- https://www.herbertsmithfreehills.com/notes/crt/2024-posts/Draghi-Report-makes-wide-ranging-recommendations-to-boost-European-competitiveness

- https://www.faz.net/aktuell/wirtschaft/christian-lindner-warnt-vor-neuen-eu-schulden-noch-ein-eu-kreditprogramm-19733993.html

- https://pism.pl/publikacje/przelomowa-decyzja-ue-ostateczne-cla-na-chinskie-samochody-elektryczne

- https://en.wikipedia.org/wiki/Tesla,_Inc.

- https://www.windowscentral.com/software-apps/openai-could-be-on-the-brink-of-bankruptcy-in-under-12-months-with-projections-of-dollar5-billion-in-losses