- Andrzej Krajewski

Detroit - once the capital of the American and global automotive industry. In 1960, it was the richest city in the United States and one of the richest metropolises in the world. Fifty years later in 2013, the city was much closer to being called the "capital of misery" in America's "Rust Belt." A metropolis scaring visitors with the highest crime rate in the United States and a frightening unemployment rate of up to 40 per cent of the city's adult population.

After more than a decade, however, the city is different. It still doesn't resemble the glory years of the Cold War, but the Detroit of 2024 exudes fresh energy. Today it is a centre of modern industry, rising from ruins, with an unemployment rate of 8.9 percent.

The new life of Detriot is somewhat demonstrated by the "Reindustrialize 2024" conference, held in June this year, which was attended by more than 500 heads of industrial companies from across the United States.

The session was opened by the originator and co-organiser of the event, Chris Power—founder and head of industrial automation startup Hadrian. In interviews with the media, Power boasts that he came to the US from Australia in 2019 with only $6,000 in his pocket. However, he believed in the American dream and that the United States needed to rebuild its industry. Barely four years have passed, and Hadrian's company has launched two factories that produce high-tech products, generating revenue of $20 million a year. Power wouldn't have achieved this success if investors hadn't previously entrusted him with $9.5 million, convinced by his business plans. He likes to say that in addition to finance and management, he also studied history.

"History repeats itself. In particular, the cycle of the rise and fall of empires" - Power often stressed in interviews with the media.

He also referred to this thesis in his speech at the "Reindustrialize 2024" conference. He began it with the words: "We turned hard industrial power into financial gains; today we are paying for the mistakes of the 1980s and 1990s. This is the same mistake that every great empire makes.".

These words were listened to attentively by the entrepreneurs mostly as young and dashing as Hadrian's founder. Power told them about the enormous cost to Americans of the stupid choices made by politicians at the end of the last century. But he did not descend into pessimism.

He mentioned that the U.S. has spent several decades building up the "industrial power of the Chinese Communist Party," and it's time to put an end to that, as a battle is brewing between the two superpowers over which will become the globe's largest industrial power.

The stakes of this game are enormous. "it will decide whether the West will rise or fall within this decade." Because the winner will control the development of artificial intelligence, the settlement of the solar system and impose its values on the entire world. Finally, the speaker announced that in the United States: "Since World War II, each generation has turned out to be fundamentally less serious. And the US was built by serious people. Not drunks, poets and fools, but serious people."

When Power finished his speech, five hundred heads and chief executives of industrial companies from across the United States gave him a long ovation.

Power and Detroit are the personal and physical manifestations of the change currently taking place in the industrial policy of the United States of America. A change that is expected to reverse decades of negative processes for America that have weakened it and at the same time strengthened its main competitor. This change could most easily be described by the word "reindustrialization."

After decades of operating on profits generated by the US financial system but without fundamentally adding value to the product, the elites of the world's greatest superpower are going back to basics - manufacturing and controlling the production of physical goods. How does this manifest itself, what does it mean, and why might Donald Trump and Joe Biden shake hands on this issue?

First signs of a giant waking up

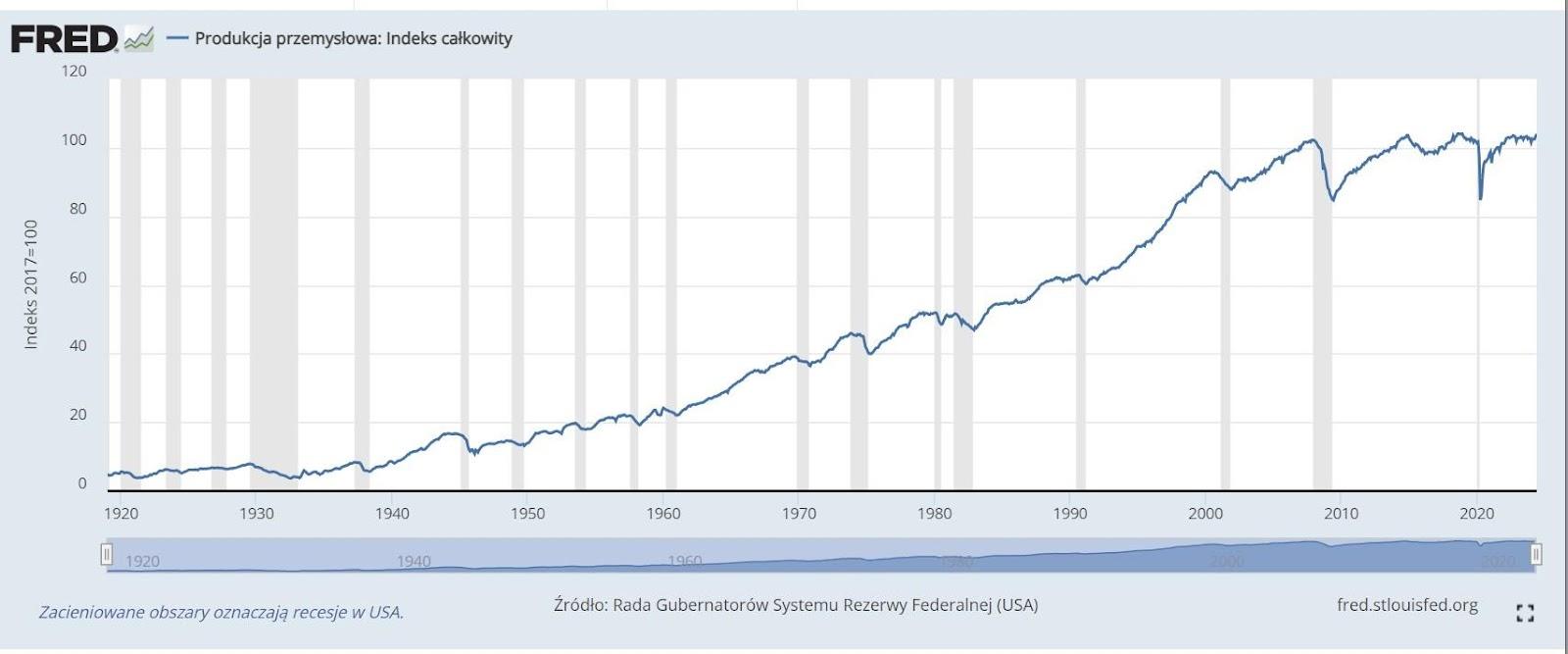

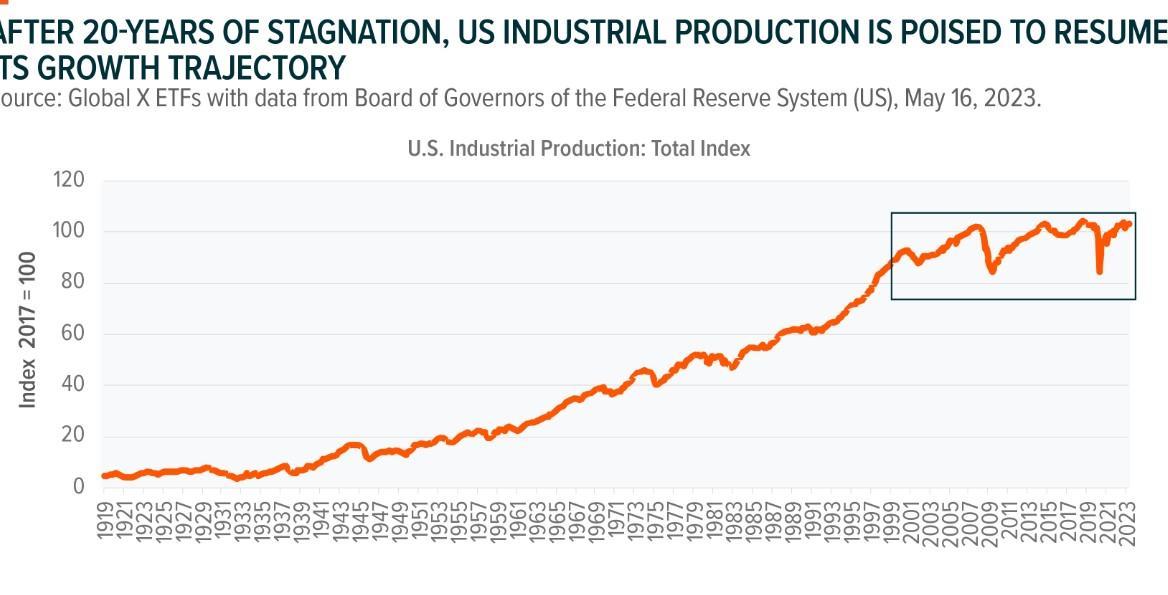

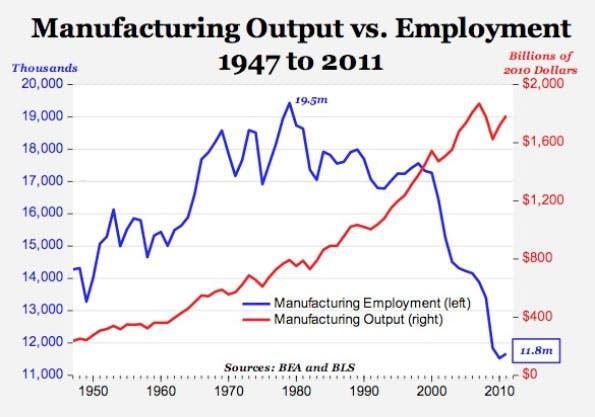

If you look at Federal Reserve Economic Data statistics, it's easy to see that in the United States, industrial production since World War II grew with small adjustments continuously until 2008.

Yet from the end of the 20th century, it grew very slowly, while the global financial meltdown brought a decline not seen since 1930. After recovering from the crisis, it managed to return to 2008 levels, followed by complete stagnation, which has continued until today. It lasted de facto for the last twenty years.

This was the price of globalization promoted by the United States since the end of the Cold War. Its most essential elements became the removal of tariff barriers in the world to promote free trade and the relocation of manufacturing companies to the Far East. Mainly to China. Symptomatically, the halt in the development of industry in the US, coincided with the admission of the Middle Kingdom to the World Trade Organization (WTO) in 2001, something the Bill Clinton administration was a great advocate of. Soon China's share of world exports rose from a mere 2 percent to a significant 15 percent, with primary exports becoming manufactured goods. This made the communist-ruled state, an economic superpower.

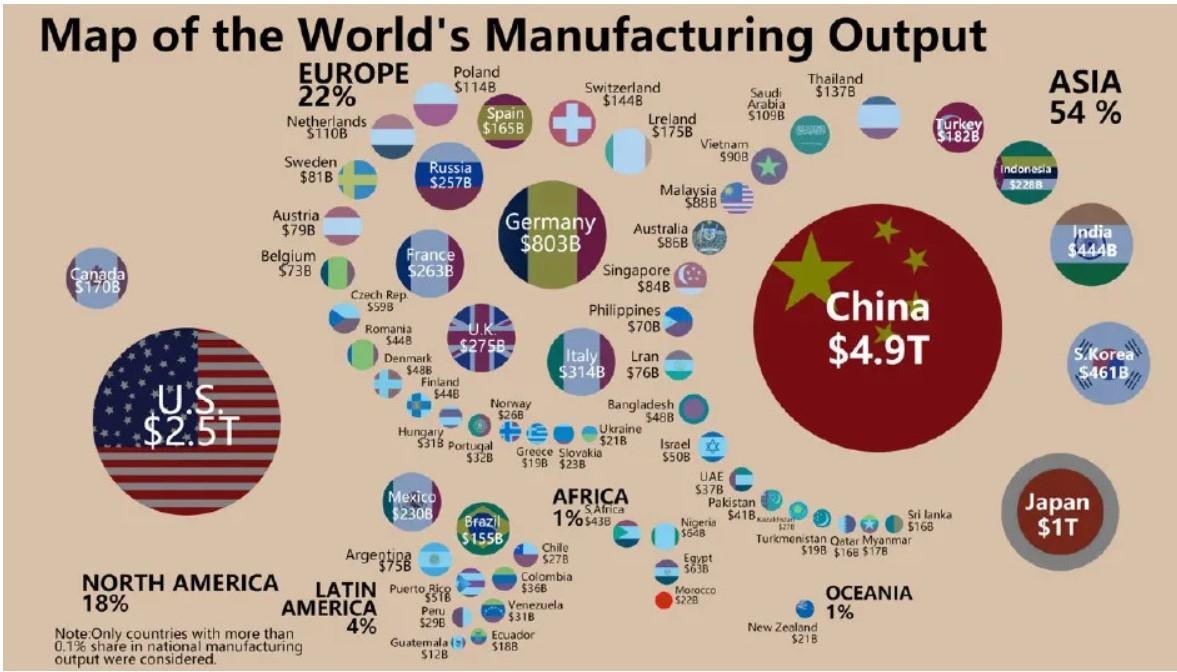

In just two decades, the value of China's manufacturing sector has reached a staggering $4 trillion. This means that more than 28 percent of the world's industry was located in China. In contrast, the value of the U.S. manufacturing sector stopped at $2.33 trillion and its share of the global industry fell to just over 11 per cent

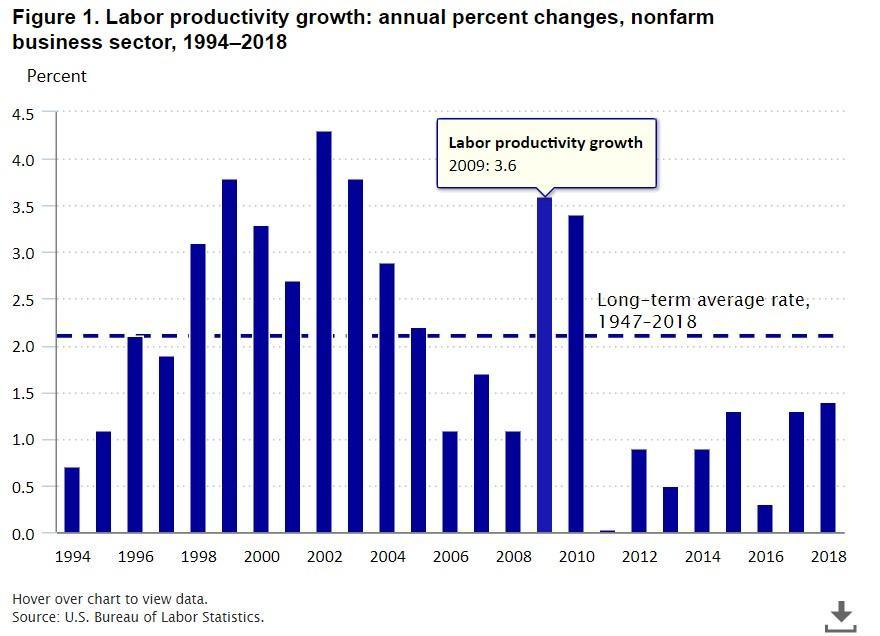

After falling into stagnation, the last engine of growth in U.S. industry was increased worker productivity. But it, too, eventually faded.

After falling into stagnation, the last engine of growth in U.S. industry was increased worker productivity. But it, too, eventually faded.

The case of new investments in the industrial sector was very similar. Their amount can be put in just three words - twenty years of stagnation.

Yet, at the end of 2022, something abruptly began to change. Instead of resembling a slow-waving sea, as it had been for years, the graph depicting the amount of money invested in the U.S. manufacturing industry suddenly began to behave like an Elon Musk’s "Starship" rocket taking off.

Literally, from month to month, investment rose from $60-70 billion per quarter to about $140 billion. Thus, there has been a more than doubling of the index, heralding that change is coming for US industry. The US reindustrialisation started to surprise many with the pace of change and its momentum. All it takes is for U.S. and foreign capital to love the U.S. soil again.

"A review of FDI (Foreign Direct Investment - author's note) in the U.S. conducted by Colliers in 2023 showed that cross-border investment in the U.S. exceeded expectations," noted Forbes magazine in late March 2024.

According to a report by consulting firm Colliers, the number of new jobs in the U.S. in 2023, thanks to Foreign Direct Investment, increased by 6% across all industry sectors, while such investments in the U.S. have increased by as much as 65% since 2019.

"Despite the popular narrative that manufacturing jobs are shifting from the U.S. to Asia, Asian investment in the U.S. remains particularly strong, with South Korea leading the way as a source of FDI. Investment by South Korean companies in U.S. manufacturing increased by 6 percent in 2023 compared to the previous year, Forbes highlighted.

ING Think analysts tried to determine what this could mean in its report. According to it, industrial production in the United States will grow by 1.5 percent this year, and by as much as 3 percent next year - 2025. Solid, especially after two decades of shuddering in place.

Note that this is a sector of the U.S. economy that now directly offers 13 million well-paying jobs. For more than a century, industry and its development were the main driving force behind the growth of prosperity in the United States, and thus guaranteed the existence of a strong middle class and the very power of the country. When America had to go to war, the manufacturing capacity it had gave it a huge strategic advantage. Therefore, Germany, Japan, or the Soviet Union in a clash with the U.S. did not have the slightest chance of ultimate success in the long run. Although none of the United States' previous enemies possessed an industry as powerful as China's, the key assets that remain in Washington's hands should not be overlooked.

The U.S. Gross Domestic Product is still noticeably larger than China's, and perhaps more importantly, this gap has stopped shrinking and has even begun to widen again.

According to the IMF, in 2021 the gap between the competitors was at a record low. China accounted for 75% of US GDP (17.8 trillion dollars - China; 23.6 - US). The problem was that the American rabbit, instead of letting Beijing catch it, began to run away faster and faster. For three consecutive years, Chinese GDP was only to grow by $700 billion, while the US GDP was to increase by $5.2 trillion, bringing the proportion above to 64% (18.5 - China; 28.8 - US) and in nominal terms to a bagatelle $10 trillion today. According to the IMF, this gap is expected to remain for at least another 5 years.

This is the result of another of America's attributes of power i.e. holding the keys to the most important keystones of the global system, led by the US dollar, the cost of which, when “printed”, naturally falls on the entire world.

Adding an industrial return to its roots, the dormant magnate is awakening to life.

Fathers of reindustrialization

The industrial breakthrough that is currently taking place in the US economy has begun to raise hopes. Not surprisingly, therefore, the US polimakers want to turn it into political gains as soon as possible.

Three days after Joe Biden resigned from running for re-election, an extensive self-promotion article describing the industrial progress made under the Biden administration appeared on the White House website.

The document begins with the words: "Since day one, President Biden and Vice President Harris have worked to make “Made in America” a reality." It goes on to find a number of declarations praising the person - who is leaving the political scene - Joe Biden, while also promoting Kamala Harris.

"Under President Biden and Vice President Harris, businesses are building factories that will power our economy for years to come. The private sector has committed nearly $900 billion in investments in American manufacturing and our power sector, including sectors central to our industrial strength. Construction of factories has doubled — to a record high — after falling under the previous administration." - the “fact sheet” stressed. The last sentence is an undisguised jab to the nose for Donald Trump, but such are the rules of an election campaign. However, it should be noted here that the U.S. reindustrialization program, called “Made in America” and boasted by the Biden administration, was a de facto response to Trump's "Make America Great Again."

By 2015, despite the stagnation in which US industry was finding itself, neither President Barack Obama nor Democratic Party leaders saw a pressing need to confront the growing problem. Even though the effects of shifting production to China were becoming more acutely felt by citizens. While the US economy recovered quickly from the global financial crisis after 2008, the number of people living in poverty in the US exceeded 46 million in 2011. Never in the history of the United States have there been so many of them. As the ABC News noted in early November 2011, "compared to the 1990s the poor are more likely to be white, live in the Midwest, have a high school diploma and own a home" .

A Brookings Institute report published at the time said that while the poverty rate did not yet exist during the Great Depression of 1929-1935, a third of American families were experiencing it at the time, according to contemporary estimates. In 2010, 15.1 percent of US families had incomes below the poverty line. However, because the population has nearly tripled since 1940, more Americans are in poverty today than during the Great Depression - the report highlighted.

At the same time, the phenomenon of rapid impoverishment primarily affected the old industrial centers, very prosperous only a generation earlier, located in the US Midwest. The states in question were : Indiana, Illinois, Michigan, Missouri, Ohio, Wisconsin, Pennsylvania, West Virginia and New York State. The area of growing poverty resulting from deindustrialisation has become known as the "Rust Belt."

Sociologists studying the phenomenon cited the main social scourges affecting residents of these states as high unemployment, going hand in hand with high rates of crime, drug abuse, and broken families. This was accompanied by a decline in education and public services. Finally, depopulation was taking place, as whoever could afford it fled the "Rust Belt" to the east or west coast of the US.

The emergence of the term "Rust Belt" in the broader public discourse and Detroit's 2013 bankruptcy announcement made it increasingly apparent that 8 million jobs have been lost in US industry since 1979.

It is also no coincidence that during the same period there was a huge shift in wealth, which shifted to the top 20 percent of earners at the expense of the poorest 80 percent - the president of MPC Management consulting firm Michael P. Collins highlighted on IndustryWeek in September 2015.

Three months earlier, Donald Trump announced his intention to run for president. Initially, political analysts did not take him seriously, but he very quickly climbed to the top of the polls. He made the collapse of the U.S. manufacturing sector and the consequences of this for the country, one of the key points of his election campaign. He put the key problems of the United States in very simple terms. They were transformed into messages perfectly tailored to the feelings of the people of the "Rust Belt." This was already noticeable when Trump announced his intention to run for president on June 16, 2015. In a speech delivered at the time, he communicated to the audience; "Our country is in serious trouble. We don’t have victories anymore. We used to have victories, but we don’t have them. When was the last time anybody saw us beating, let’s say, China in a trade deal? They kill us. I beat China all the time. All the time."

He added: "When did we beat Japan at anything? They send their cars over by the millions, and what do we do? When was the last time you saw a Chevrolet in Tokyo?."

Trump focused on the problems of the U.S. losing the competition with Far Eastern countries on the industrial and commercial fronts, and the exploitation of America by all its allies. The US has become the dumping ground for everyone else's problems, he - claimed. This is how he grew from the least serious candidate to the winner of the 2016 presidential election, while spreading the promise to restore America to its former glory - Make America Great Again.

He was backed by residents from states that have proven to be victims of globalization and the industrial relocation that goes hand in hand with it - mainly to China.

During his presidency, Trump has made a series of moves to stop further industrial flight from the US, focusing primarily on undermining one of the pillars of globalisation - free trade.

In 2017 The United States left the Trans-Pacific Partnership. The free trade agreement between 12 Pacific Rim countries which was authored by Barack Obama - who considers it the crowning achievement of his presidency. The Trump administration has also renegotiated the 1994 North American Free Trade Agreement, which the president says was responsible for the loss of millions of industrial jobs to Mexico.

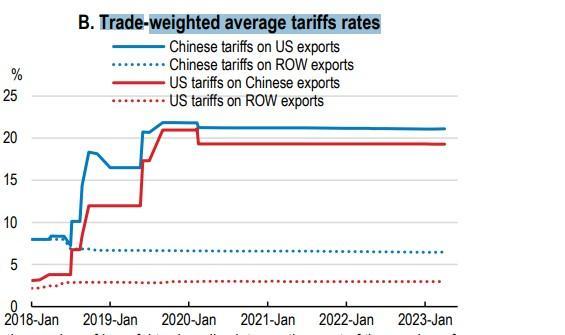

In parallel, Trump, under the slogan "America First," initiated a tariff war with China. He successively raised tariffs on products imported from the Middle Kingdom, most of which were industrial products, taking advantage of the fact that it is the US president who decides on tariffs. On this occasion, Trump also hit selected products from Europe with them, most notably - steel and aluminium. However, it was Beijing that remained his main enemy, against which the tariff weapons were used, heavily. The average tariffs had increased 6-fold by the end of Trump's presidency. And China responded with the same.

These actions made industrial products produced in China increasingly expensive and less competitive in the US market. However, contrary to the expectations of the White House, this did not pull domestic industry out of its slumber or increase the amount of investment placed in it by domestic and foreign investors. Nor has there been a massive move of Western investors from the Middle Kingdom to the US. Even the withdrawal of the United States from the Paris climate agreement, imposing an obligation to reduce CO2 emissions, which entails additional costs for industry, did not bring about the trend desired by Trump. Yet it should be remembered that unluckily for him at that time the COVID pandemic swept through the world, destabilizing the global economy. In any case, industrial production in America continued to languish.

The then-president diagnosed the disease very well, but the drugs he prescribed for it proved to be of little effect. Well, except perhaps one - the fear he inspired. Terrified of Trump, the Democrats, when Joe Biden won the election, immediately took action. They reached for a strategy that was the opposite of the one laid out a decade earlier by Barack Obama. The United States was finally breaking away from its role as a global gatekeeper and promoter of free trade (and therefore globalization), taking a course toward protecting its own market and reindustrialisation.

Centrally controlled industrial reconstruction

Biden and his entourage approached the problem of reviving industrial production in the US from a completely different angle than Trump. Yet using the Trump card of already exorbitant tariffs. To these they added new legal provisions that created a whole system: regulations, tax breaks and state subsidies designed to guarantee the achievement of a single goal. To give investors confidence that if they put up the capital to build an industrial plant in the U.S., it would pay off for them. At the same time, the whole thing was formatted in such a way that investments in manufacturing related to renewable energy sources and energy transition received the highest guarantee of profitability. By the way, the Biden administration has actually done exactly the same thing as the leaders of Communist China a dozen years earlier.

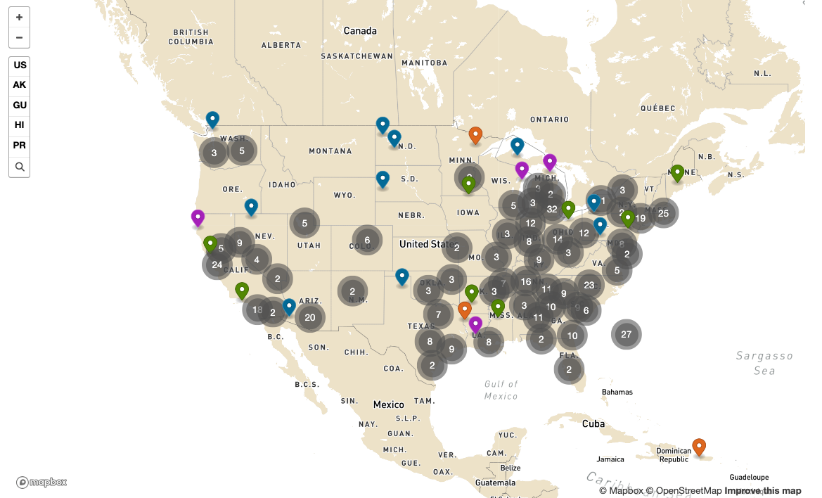

The pillars of reindustrialization have become three laws. The Infrastructure Investment and Jobs Act (IIJA) was passed by Congress in 2021, The CHIPS and Science Act was adopted in 2022, and in the same year: The Inflation Reduction Act (IRA). This triad is complementary and, according to an official White House announcement of July 24, 2024, provided for the creation of: "nearly 800,000 manufacturing jobs after the last administration lost manufacturing jobs."

The Biden administration considers the most important thing from a strategic point of view to be the investment of some $400 billion by 13 companies in the construction of semiconductor factories, backed by $30 billion in government subsidies and $25 billion in preferential loans. These gigantic sums are expected to provide America with a breakthrough, leading to independence from the need to purchase semiconductors from foreign manufacturers - led by Taiwan. This is invaluable at a time of escalating conflict with China. These are components without which no modern device can function, from a TV remote control to a fifth-generation jet fighter. Cutting off regular supplies of semiconductors today would mean a meltdown for the U.S. economy, as well as seriously weaken the U.S. military potential.

A June 2022 report by The Center for Strategic and International Studies (CSIS) framed the problem as follows: "All major U.S. defense systems and platforms rely on semiconductors for their performance. Consequently, the erosion of U.S. microelectronics capabilities poses a direct threat to the ability of the United States to defend itself and its allies.". According to the report's authors, without the production of its own semiconductors, the United States was doomed to lose the ability to defend even its own territory, not to mention the territories of allied countries. Therefore, even the Department of Defense, as part of the reindustrialization program, began to fund new research centers from its budget, dedicated to the development of semiconductor technologies and preparing them for deployment by industry. An informative White House communiqué dated July 24, 2024, stresses that: "we are well on our way to revitalizing our domestic semiconductor industry by creating more than a hundred thousand jobs across the country..

Intel, using support guaranteed by The CHIPS and Science Act, has invested $20 billion in new semiconductor manufacturing facilities in Ohio. And Taiwanese chipmaker TSMC has poured $65 billion into three new plants in Arizona, receiving $6.6 billion in support from the US government. The Asian company wants to start manufacturing semiconductors there as early as 2025.

Yet numerous complaints from new TSMC employees, shocked by the murderous pace of work imposed by the Taiwanese, have leaked to the US media. In response, the director of communications and labor relations at the corporation's Arizona subsidiary, Richard Liu, said that in order to help deal with the cultural conflict, TSMC is sending US employees to Taiwan to observe the Taiwanese way of life. At the same time, it is conducting communication training for its managers to help them better interact with US employees. On the other hand, the possibility of not executing the set investment plans is not considered at TSMC. And their execution means the gradual transfer of semiconductor production from Taiwan to the US.

In this context, let's look at Europe. Prior to the passage of the tri-package of Biden laws, Intel unveiled a broad plan for investment in Europe. A research and development center for artificial intelligence and supercomputers was to be built near Paris, while a €4.5 billion semiconductor factory in Italy. To complete the set, twice as large near Magdeburg in Germany and a smaller one near Wroclaw, Poland. At the beginning of July 2024, Intel's top management, without much uproar, decided that investments near Paris and Italy would not be completed in the near future. This was explained by the troubles into which the company had fallen and the threat of financial losses. In the case of the plant near Magdeburg, the concern in order to complete the project expects subsidies higher than 10 billion euros from the German government. Otherwise it will find it unprofitable to invest in Europe.

Americans play without mercy

The effects of U.S. protectionism and the start of the reindustrialization battle will only begin to be felt by both China and Europe.

For example, take the Build America Buy America Act, enacted on November 15, 2021, as a component of the previously mentioned IIJA, or The Infrastructure Investment and Jobs Act. The law commonly referred to as: "Buy American" mandates, among other things, that any product purchased by the federal government (any government procurement) must consist of 65 percent U.S.-made components. With this threshold being raised to 75 percent in 2029, the same is true for investment subsidies. Thus, if the Broadband Equity, Access and Deployment (BEAD) program plans to spend $42.4 billion to expand an ultra-high-speed broadband Internet network in the U.S., all sorts of technical equipment for it will have to be manufactured in the U.S. and ultimately consist of 75 percent components also made on U.S. soil. The same is true for electric cars, wind turbines, photovoltaic panels, batteries, etc. The Biden administration has offered a broad package of support for investments related to the production of equipment critical to the great energy transition and the shift away from fossil fuels. But in return, it requires their Americanization.

Thus, according to the standard already in place today, no less than 40 percent of the components of a battery manufactured in the US must be made from components also made in the US. But in 2026, this threshold will automatically rise to 80 per cent already.

Investors went for it, and as the White House boasts in its announcement: "Since President Biden and Vice President Harris took office, companies have announced more than $250 billion in investments in U.S. clean energy and electric vehicle manufacturing.".

Meanwhile, the package still includes $20 billion in grants, for example, to upgrade and expand port infrastructure in the US. But only companies operating in America and using American machinery can take part in this program. For this reason, the Japanese conglomerate MITSUI E&S, which specializes in such investments, and its U.S. subsidiary PACECO, have decided to move production of port cranes to American soil. After a 30-year hiatus, these specialized devices, will again be manufactured in the United States. The Department of Homeland Security also played its role here.

At the beginning of 2024, presidential executive directives were released, to new regulations prepared by the said department. They concerned the security of ships, ports and waterfront facilities, as well as cyber security in these areas. After the regulations went into effect, port equipment manufactured in China, including primarily cranes, proved to be a threat to US national security.

So, the only thing left for MITSUI E&S is to relocate its plants to the United States. Yet the Japanese should not complain, having eliminated Chinese competitors.

Such examples of how the Americans have started to play hardball continue to abound. Spending 3 billion in federal funds on high-speed rail projects will follow exactly the same rules. So will subsidizing the expansion of 40 charger plants for electric cars, and then supporting the development of charger networks across the US.

"This new policy for EV chargers restored Buy America standards for these products, while also giving time for supply chains to adjust — allowing newly announced manufacturing capacity for EV charger components the necessary time to ramp up production." - boasted the White House in its July 24, 2024 announcement. The sum planned to support the development of a network of US-made chargers is $7.5 billion.

This pattern of action can be repeated by the federal government for any industry it deems forward-looking or strategic. Yet for the Biden administration, the priority has been investment in industries related to clean energy generation and energy transition. More than 450 different investments worth a total of more than $160 billion have been so initiated.

However, it is too early to talk about the total success.

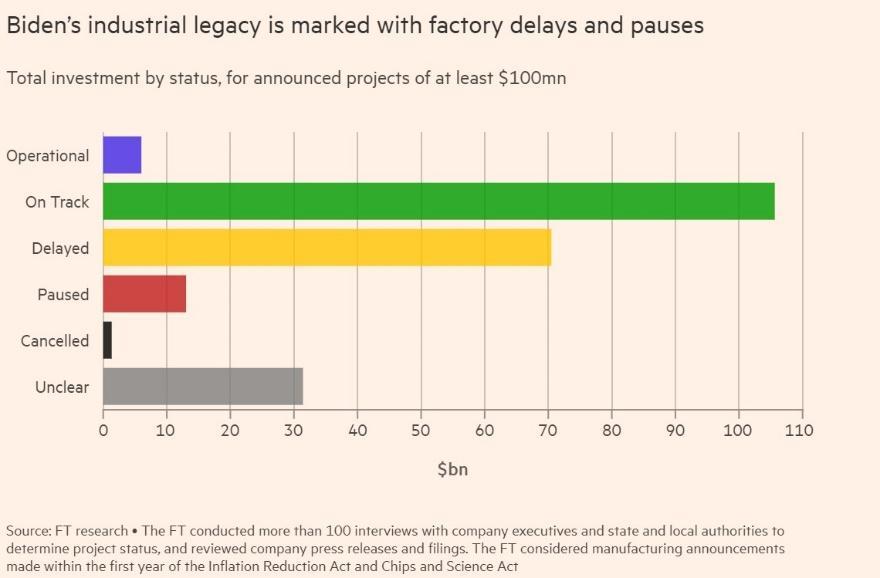

Weaknesses of central planning

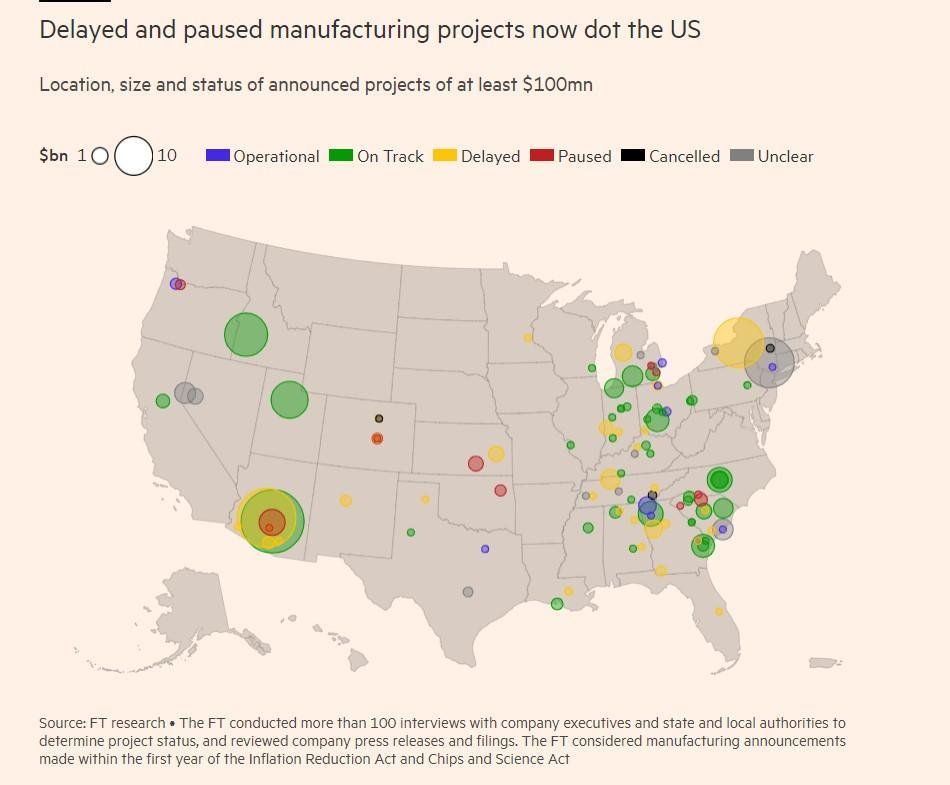

In the grand plan for reindustrialization of the US, undertaken by the Joe Biden administration, its weaknesses also began to manifest themselves. Typical, moreover, of ventures based on central planning and dependent on the government and the public subsidies it offers. According to findings made by a trio of Financial Times journalists in early August 2024, as many as 40 percent of major production projects supported on the basis of The Inflation Reduction Act (IRA), and therefore from the electromobility and energy transition industries, have suffered delays in implementation or have even been halted. We are talking of investments worth a whopping $84 billion. The Financial Times cites as reasons for this the weakening demand for such industrial products (especially electric cars), overproduction of wind turbines, solar panels and batteries in China, and uncertainty about the future occupant of the White House.

As the Financial Times notes - although IRA tax credits are in effect until 2032, and the Chips Act grants generous funding to selected applicants, companies often can't receive funding until they reach certain production milestones. In turn, they are afraid to start investing today before the new administration confirms that the subsidies will remain. In addition, the turmoil affecting financial markets is also leading to caution. They are fueling fears that the U.S. economy may soon face a recession. And this is not conducive to planning new investments, especially in the manufacturing sector.

However, this will not reverse one thing - the dramatic shift in the view of what the US economic development model should look like in the future. Both Republicans and Democrats already agree that free trade and the free flow of investment and capital, driving globalisation, are no longer serving the American nation. Like a mighty ship, America could not make a turnaround in its course of almost 180 degrees at once. But in just a few years it accomplished it. Now the priority has become its own industrial production, shortening supply chains, attracting investors from around the world, protecting domestic jobs and its own market. Finally, self-sufficiency in areas of the economy considered strategic. This description fits perfectly with the Chinese development strategy already adopted at the beginning of the 21st century.

The great changes taking place in the US can be illustrated by an article that appeared in late July 2024 in The New York Times by Dr. Stephen Lezak. The Cambridge and Oxford University lecturer, who specializes in climate research, calls for the restoration of ... mining in the United States. Particularly the mining of lithium and rare earth elements. In addition to issues of strategic importance, he puts ... ethical issues at the forefront. As Dr. Lezak writes - although the United States has rich deposits of many valuable minerals used in our vehicles, electronic devices and buildings, they are mined mainly abroad, in poorer countries where labor is cheap (or worse, the workers are slaves) and environmental regulations are more lax, rarely enforced or can be easily circumvented with bribes. He goes on to add a long list of examples of what damage has been done by moving the mining industry outside the US. He lists, among others: "widespread child labor and sexual violence" in Africa, the destruction of rainforests in Indonesia, and the poisoning of groundwater in Mongolia. All these misfortunes, in the author's opinion, could be reduced if the extraction of raw materials necessary for the energy transition were carried out on US soil. "The ethical and strategic way to deal with this situation is to encourage the federal government and environmentalists to return this industry to the United States and hold it to the highest standards of sustainability." - Dr. Lezak emphasizes in the pages of a magazine consistently supportive of the Democratic Party.

The text fits well with the not-so-exposed efforts of the government's Office of Fossil Energy and Carbon Management (DOE), which has been supporting projects in the US since 2022 to locate and then prepare for the exploitation of deposits of rare earth elements and other raw materials considered strategic. Laying the groundwork for the rebuilding of the mining industry in the United States.

The whole thing can therefore be summed up in a sentence - industrial policy has triumphantly returned to Washington after a decades-long hiatus. And whoever will be the new occupant in the White House, it shall remain in the American capital.

Europe with the US in the background.

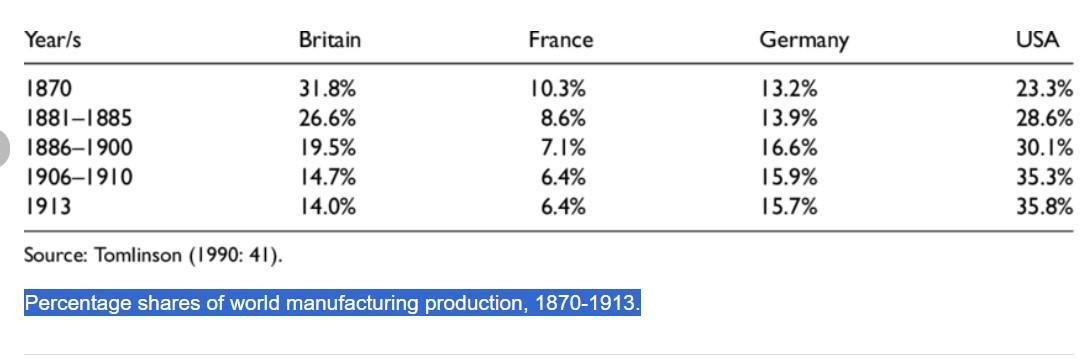

The last great passing, as far as the economic race between the superpowers is concerned, happened about a century and a half ago. At that time, when Britain and its navy were the guardians of free trade on a global scale, the United Kingdom could boast that back in 1871 as much as 31.8 percent of the world's industrial production was provided by British industry. In the same year, the United States was already in second place in the ranking, generating 23.3 percent of industrial output. Third place was occupied by the just-united Germany, with industry guaranteeing 13.2 percent of global output.

Yet, in a short period of time, the Americans took a leap that was simply unimaginable. And, as it turns out, very similar to the one made by China in the 21st century.

Already in 1906, US industry accounted for 35.3 percent of world output, British industry barely for 14.7 percent, beaten also by the German industry at 15.9 percent. At the same time, neither Great Britain nor Germany stopped growing economically during this period. The impression that the two European powers stagnated comes from the fact that the United States skyrocketed, growing 4 or 5 times faster then its competitors. The gap widened even before the outbreak of World War I.

After the war, it was virtually a mere formality that Britain had to come to terms with the fact that the role of the world's most powerful country was being taken over by the US. World War I only allowed the British, severely weakened by it, to swallow this bitter pill more easily.

It is worth tracing how this exchange of leadership took place. As already mentioned, Britain, since the Napoleonic wars and the breaking of the power of France, stood for free trade on a global scale. It guaranteed the world's largest colonial power's economic development. Merchant fleets, trade companies, banks, the London Stock Exchange, huge numbers of investors - all profited from global trade. In the case of British industry, it adapted its development to the demand generated by the domestic market and the colonies. As early as 1840, Foreign Minister Lord Palmerston, in a letter to then Governor General of India Lord Auckland, explained that in Europe the competition between products from factories from different countries was steadily intensifying. Thus, as he wrote: "In order to compete with European manufactures, we must quickly exclude our productions from European markets. So it is necessary to strive relentlessly to find new markets for our industry in other parts of the world (...). If we succeed in our expedition in China, Abyssinia, Arabia, the countries on the Indus and the Pacific will soon become an important extension for our trade". The British colonization of China soon took off, becoming, after India, an additional market for the UK economy. In addition, giving away its greatest riches in the form of silver resources, tea and handicrafts in exchange for opium, which was very cheap to produce.

Britain's greatest strength, ensuring its economic dominance on a global scale, turned against it after the unification of Germany. Under Bismarck, the Second Reich began to pursue a protectionist economic policy, supporting the expansion of domestic industry. The Iron Chancellor used a huge contribution of 5 billion francs in gold, paid by France after losing the war, as capital to initiate the change. Most of this sum was pumped into the banking system and infrastructure investment. Easy access to cheap credit brought an economic boom to the Second Reich. Private investors built 20,000 kilometers of railroads, while some 900 new companies, mainly engaged in industrial production, began offering their shares on the Berlin Stock Exchange. The government in Berlin supported them with protectionist tariffs. The Alfred Krupp plant, employing more than 70,000 workers, grew into Europe's largest conglomerate. The concern, which produced, among other things, excellent steel and guns, proved capable of rapidly launching new, technically constantly improving products and conquering markets in other countries.

Meanwhile, the much smaller British steel mills did not have to contend with any serious competitor for several decades. Access to easy colonial markets forced neither innovation nor the creation of large corporations. This fact held tremendous significance, because steel was the key industrial product in the 19th century. It was from it that hundreds of thousands of kilometers of railroads, all kinds of machinery, weapons, bridge spans and building frames were built. In a few years, Krupp, backed by its own government, eliminated British steel mills from European markets. The same happened in other sectors of the economy: chemicals, textiles, machinery. To top it off, London shot itself in the foot, at the very beginning of the second industrial revolution, driven by motorization and electrification. In 1865, the British Parliament passed the "Red Flag Act." Mandating that a man with a warning red flag walk in front of every motorized vehicle traveling on the road. Over the next two decades, the law killed England's fledgling automobile industry. Its European center became Germany.

It was in Germany that the largest number of internal combustion engines and vehicles powered by them were produced. It wasn't until Lord Salisbury's government began to notice that things weren't going in the right direction. So, he set up the Royal Commission on the Crisis in Trade and Industry. Its report, published in 1886, pointed out that the protectionist policies of the Second Reich were killing British industry. However, Britain could not break away from the dogma of maintaining free trade, defending it at any cost. Therefore, the commission and Salisbury came up with a solution that, as he thought, allowed him to "eat cake and have it to o." On the Prime Minister's initiative, the House of Commons passed a law in 1887, making it mandatory for German products to be labeled "Made in Germany." Robert Salisbury lived in the belief that, seeing such a warning, every Briton would choose home-made goods. Meanwhile, the indication that something was made in Germany quickly became a symbol of superior quality. Because the products of German industry, forced to fight for new markets, turned out to be better than British ones. However, London was still wary of launching a tariff war, as the government believed British trade would suffer the most. So the Salisbury government entered into discreet talks with Bismarck about cooperation. And the latter agreed to ease protectionist policies, and in the last decade of the 19th century, although the German economy was already growing much faster than the British, the conflict was eased. The European powers, preoccupied with themselves at the time, completely missed the moment, of the entry of the United States into the game.

America takes the stage

If one were to look for a symbol illustrating how the U.S. became the world's greatest industrial superpower, it should be the "Bessemer Process". It combined Britain's chance to maintain its dominance, which was squandered, with how the opportunity was seized by the Americans and given back to no one.

The second half of the 19th century was characterized by a constant hunger for steel due to insufficient production in the face of growing needs. In a classic metallurgical furnace, one smelting of iron, along with supplementing the pig iron composition with coal and other additives, took about a week. It wasn't until English inventor Henry Bessemer, although he had a vague idea of metallurgy, that in three weeks he designed a novel furnace model in the shape of a pear, with a blower added to it. The blower raised the combustion temperature and allowed faster removal of impurities from the pig iron. When he presented the "Bessemer pear" in Cheltenham on August 24, 1856, it smelted excellent steel in just 20 minutes. In doing so, he used seven times less coal than was needed in a classic steelmaking furnace per smelting.

This was a revolution on the scale of the invention of the steam engine. But when Bessemer's process began to be repeated in his converter, very poor quality steel was obtained. It wasn't until 1878 that Welsh metallurgist Sidney Gilchrist Thomas discovered the problem. During his first demonstration of smelting, Bessemer accidentally used iron contaminated with phosphorus. With this addition, he obtained very high-quality steel. But Thomas' discovery did not interest any British steelworks. Meanwhile, it turned out that from Bessemer the patent for his invention was bought back by locomotive designer and founder of the American Society of Engineers Alexander Holley. An emigrant from Scotland, Andrew Carnegie, entered into a partnership with him. He brought together a group of businessmen willing to put up funds to create a metallurgical concern. As he calculated with Holley, their state-of-the-art steel mill could produce a ton of rails for $69. Traditional steel mills could not go below $100 per ton. Soon, Carnegie proved to be a real shark, ruthlessly eliminating competitors from the market.

When any of the competing steel mills went into debt, he would buy them out. The Carnegie Steel concern took over most of the American steel mills within two decades and immediately switched them to the new technology. The products of British steel mills disappeared from the United States. However, the one thing Carnegie was unable to do was to drive Krupp's products out of the US market. His most formidable rival, was just as quick to introduce new ways of smelting steel. He also reached for technology developed by Pierre Martin. The Frenchman noticed that great amounts of energy were lost in the Bessemer process when blowing molten iron, with cool air. So he replaced it with gas obtained from burning coal dust. The “Siemens–Martin frunace” smelted steel more slowly than Besemer's, but the cost of production fell, and still allowed the production of various types of alloys. As a result, railroads and skyscrapers were built with German steel in the United States. And Carnegie Steel was fleecing big government contracts, including for supplying steel for the hastily expanded US Navy.

This is because Washington, like London, stood by the position that free trade and low tariff barriers were the foundations of getting rich. Until social unrest began to shake the United States. Poorly paid workers, working 12 hours a day and constantly at risk of being fired, revolted. The bigger and more violent the protests became, the more violently they were suppressed while labor leaders landed in prison. The apogee of the rebellion came during the world-famous Chicago riots, which broke out on May 1, 1886, during which six policemen and dozens of protesting workers were killed.

At the time, a number of politicians took the workers' rights to their banners. But one of them did so in an unusual way. William McKinley began his political career in 1876 by taking on the defence of a group of miners arrested after a strike and clash with police. For free. Although the case looked hopeless McKinley proved himself a brilliant lawyer and led to their acquittal. With this he gained enormous sympathy among workers throughout the state of Ohio. Then running for president, Rutherford B. Hayes persuaded the friend to run for the House of Representatives. As a congressman, McKinley became preoccupied not only with workers' rights, attracting their votes to the Republican Party but also with promoting the idea that the US should impose high tariffs so that they would protect domestic mining and industry. With which he initially infuriated Republicans.

However, as a congressman, he persistently fought for the implementation of the demand. But after major labor protests in the late 1880s, he got his way. In 1890, Congress passed the "McKinley tariffs." He himself soon won election as governor of Ohio, and in 1896, the presidential election. Four years earlier, taking advantage of the general wave of support for raising tariffs, Andrew Carnegie personally went to the White House. President Gover Cleveland, who resided there, was easily persuaded that he had to impose high tariffs on foreign steel products. Thus the Krupp concern was pushed out of the US. How this decision affected Carnegie Steel's earnings is easy to trace from accounting records.... In 1893, the concern boasted $3 million in pure profit per year, and just seven years later, it was seven times bigger at $21 million.

Andrew Carnegie then became the richest man on the planet before he was overtaken by John D. Rockefeller, who in turn was overtaken by J.P. Morgan in the early 20th century. Indeed, the United States' break with free trade and low tariffs was accompanied by the rise of large monopolies, called trusts. The liquid fuels market in the U.S. and then globally was dominated by Standard Oil, created by John D. Rockefeller. In contrast, the market for banking, insurance and railroad services was in the hands of John Pierpont Morgan.

At the turn of the century, Morgan was the world's leading banker, and no company even came close to the level of power he enjoyed in the United States, writes Charles R. Morris in his book "The Tycoons".

No European company was able to compete with the American corporations of the day. Even Krupp, in comparison with them, looked merely average. European countries, led by Germany, of course began to defend their markets with tariffs, but the opponent had an advantage of scale due to the huge economic organisms the trusts had become. In addition, they had state-of-the-art technology and innovative methods of managing production. American engineer Frederick Taylor developed a system of scientific labour organisation, and Ford's automobile plants began belt production, which increased labor productivity and significantly reduced the cost of manufacturing each model.

This made American tariffs much more effective than European ones, because US corporations produced: more, better, and cheaper. Therefore, although there were only 76 million people living in the US at the beginning of the 20th century and about 400 million in Europe, US industry was producing products worth as much as those produced by British, German and French factories combined. This knockout change took place in just two decades. But the triumph had its dark side.

The power of the trusts in the United States was built at the expense of ordinary Americans. It was the monopoly corporations that imposed wages and product prices on them. Shaping them so as to have as many resources for expansion as possible. That's why at the beginning of the 20th century the average bread eater in the US sincerely hated the trusts and considered them the cause of all their woes.

But for every action in nature there is an equal and opposite reaction. And so, the youngest president in the history of the United States to this day appeared on the political scene. Theodore Roosevelt was only 43 years old at the time of his inauguration as president. At the top of the Republican Party, he did not arouse enthusiasm. It was feared that someone was coming to power who could not be tamed in any way. These fears were confirmed.

"Great corporations exist only because they are created and safeguarded by our institutions" the president announced, adding that: "and it is therefore our right and our duty to see that they work in harmony with these institutions." This is how Roosevelt began his war on trusts, which he waged using the antitrust laws and the Justice Department. It was completed later by President Woodrow Wilson. In practice, by 1913, all the big monopolies in the US had been broken up and divided into multiple, competing companies. Ordinary Americans quickly felt this in their wallets, getting richer than ever before. The process of demonopolization in the States coincided with Europe's collective suicide, including on the economic front, which was World War I. After it, for almost a century the economy of no other country was able to even come close to the American potential.

In conclusion, mentioning how Britain lost its position as the world's largest economy to the United States, even before it lost its colonial empire and its status as the most powerful of the superpowers, it is worth noting a few things. The British had all the assets they needed at hand not to sleep through the second industrial revolution, including innovative technologies and the capital needed to modernize industry. Meanwhile, they not only failed to take advantage of these opportunities but actually did everything they could to derail it. Including introducing paralyzing legal provisions.

Despite appearances, these actions were not entirely irrational. The British Empire had created a global economic and political order decades earlier, which had been a stunning success. Politicians, therefore defended the old order in the sincere belief that it was the foundation of Britain's power. Not recognizing that as a result of the technological, economic and political changes taking place around the empire, what they are doing is not helping, but hastening its decline. From the "window of opportunity" opened by London, the Second Reich sought to exploit it to become the world's greatest superpower. But seeing this threat, the British, from the beginning of the 20th century, did everything in their power to thwart Berlin's plans. Meanwhile, the country that perfectly used all the assets it possessed and took the place of Britain on a global scale turned out to be the United States. The process was relatively painless thanks to cultural proximity and London's reconciliation with the loss of its empire. Britain agreed in the end to assume the role of junior partner of the US, becoming the closest of America's allies.

Until recently, successive presidential administrations in the United States have behaved like British governments in the 19th century, upholding the global order that the US built after World War II. Only Donald Trump broke out of this pattern, and Joe Biden de facto continued the change initiated by his predecessor. Thus, we have witnessed Washington's abandonment of the doctrine of free trade and globalization in favor of protectionism and defense of its own industry. At the same time, this is only the beginning of the changes that any such radical turn in the policy of a key superpower, must bring.

Today, the United States does not want to share the fate of the British Empire and hand over its role to China - who is the equivalent of the early XX century US. However, the defence of their existing position must come at the expense of the Middle Kingdom. Thus, the U.S. reindustrialization program will, as a consequence, exacerbate the conflict with China, which somewhat fulfills the definition of a "self-fulfilling prophecy."

"Never before in history has a declining empire defeated an emerging empire.” - said Chris Power, the organiser of the Reindustrilize conference mentioned in the introduction.

However, during the deliberations, he expressed hope that this time, an exception would happen and a new generation of American industrialists would rebuild America's former glory, wealth and strength. The fact is that, like the British around 1870, this generation has all the tools it needs to do so.

Admittedly, the challenge is enormous, but not at all unrealistic to achieve. It is on these people that the United States' greatest hope for its future rests. And truth be told, the future of the entire world.

Sources:

- https://histmag.org/Detroit-jak-bankrutowal-symbol-amerykanskiego-przemyslu-22738

- https://ycharts.com/indicators/detroit_mi_unemployment_rate

- https://www.reindustrialize.com/

- https://www.hadrian.co/

- https://techcrunch.com/2024/02/21/hadrian-automations-ceo-wants-to-defy-history-and-revitalize-american-industry/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAANe9ns8ec6OWi8tkpJboOZADF9PTKnzkhbgwkdx1i95gbnNYrNulBQUqlTQQPmBA0vjlFGntx_FJuVwc55JlYXslmQpuio7ugbiSqxu6wLp4AWqNefhawy0gScVyk5VJLJF6qePtKw3iIvwMBLFET9nFY9iSA31-eJ-RXPolVW82

- https://www.google.com/search?sca_esv=8dca5a6e4fb2a16a&sca_upv=1&rlz=1C1GCEA_enPL1051PL1051&q=Chris+Power+REINDUSTRIALIZE&source=lnms&fbs=AEQNm0Dvr3xYvXRaGaB8liPABJYdGovAUMem85jmaNP43N9LWkpJzPExVfN1dM6Qi4rL-ZCUpN5qLHKOqAlKUxwZpsmlgO4P478MY3iYDYbhN5Ag-1yquA0FYUmrWorBH6Gu9C2RGIvUckG7QXTmFaNhheXczh4HuTn4nSwo5utQ3HEP4HG-tiqxoYp-tLp9CUM4mlNTqCEPnzHpVDeSWk3xq7KCgfKWbA&sa=X&ved=2ahUKEwj-84-c_MGHAxUxDRAIHTv5FnkQ0pQJegQIDxAB&biw=1163&bih=539&dpr=1.65#fpstate=ive&vld=cid:132a0369,vid:LJq1jPQi0Ec,st:0

- https://x.com/MikeSlagh/status/1782485170450272321

- https://fred.stlouisfed.org/series/INDPRO

- https://www.globalxetfs.com/from-stagnation-to-resurgence-u-s-industrial-productions-new-path-highlights-infrastructure-automation-and-commodities-themes/

- https://howmuch.net/articles/map-worlds-manufacturing-output

- https://www.bls.gov/opub/mlr/2021/article/the-us-productivity-slowdown-the-economy-wide-and-industry-level-analysis.htm

- https://www.piie.com/research/piie-charts/2024/investment-us-factories-has-soared-end-2022

- https://www.forbes.com/sites/courtneyfingar/2024/03/29/manufacturing-investment-defies-expectations-in-us-and-europe/

- https://think.ing.com/articles/us-manufacturing-outlook-better-times-are-coming/

- https://www.whitehouse.gov/briefing-room/statements-releases/2024/07/24/fact-sheet-biden-harris-administrations-progress-creating-a-future-made-in-america/

- https://abcnews.go.com/blogs/politics/2011/11/poverty-rate-doubled-in-the-midwestern-rust-belt-over-past-decade

- https://www.britannica.com/place/Rust-Belt

- https://geekweek.interia.pl/raport-miasta-jak-z-horroru/news-niezwykle-detroit-upadle-amerykanskie-miasto-i-jego-historia,nId,6028299

- https://www.industryweek.com/the-economy/competitiveness/article/22007267/the-financialization-of-the-economy-hurts-manufacturing

- https://time.com/3923128/donald-trump-announcement-speech/

- https://www.reuters.com/article/world/factbox-donald-trumps-legacy-six-policy-takeaways-idUSKBN27F1GH/

- https://businessinsider.com.pl/finanse/handel/donald-trump-wprowadzil-cla-na-stal-i-aluminium/nc9n1sg

- https://en.wikipedia.org/wiki/Infrastructure_Investment_and_Jobs_Act

- https://en.wikipedia.org/wiki/Inflation_Reduction_Act

- https://en.wikipedia.org/wiki/CHIPS_and_Science_Act

- https://www.whitehouse.gov/briefing-room/statements-releases/2024/07/24/fact-sheet-biden-harris-administrations-progress-creating-a-future-made-in-america/

- https://www.csis.org/analysis/semiconductors-and-national-defense-what-are-stakes

- https://www.whitehouse.gov/briefing-room/statements-releases/2024/07/24/fact-sheet-biden-harris-administrations-progress-creating-a-future-made-in-america/

- https://constructionreviewonline.com/commentary/intels-20-billion-ohio-plant-a-look-at-the-latest-updates/

- https://www.tomshardware.com/tech-industry/semiconductors/tsmc-arizona-struggles-to-overcome-vast-differences-between-taiwanese-and-us-work-culture

- https://www.politico.eu/article/intel-pauses-french-italian-microchip-investments-after-manufacturing-loss/

- https://www.commerce.gov/oam/build-america-buy-america

- https://broadbandusa.ntia.doc.gov/funding-programs/broadband-equity-access-and-deployment-bead-program

- https://www.oecd.org/en/publications/oecd-economic-surveys-united-states-2024_cdfff156-en.html

- https://www.whitehouse.gov/briefing-room/statements-releases/2024/07/24/fact-sheet-biden-harris-administrations-progress-creating-a-future-made-in-america/

- https://www.seatrade-maritime.com/ports/biden-administration-bring-port-crane-manufacturing-back-us

- https://www.environmentenergyleader.com/2023/09/new-map-shows-where-clean-energy-investments-are-being-made-in-usa/

- https://www.ft.com/content/afb729b9-9641-42b2-97ca-93974c461c4c

- https://www.cmcmarkets.com/pl-pl/puls-rynku/suma-wszystkich-strachow-uderza-w-rynki-finansowe-wracaja-wydarzenia-z-2007-roku

- https://www.nytimes.com/2024/07/23/opinion/lithium-copper-minerals-mining.html

- https://www.energy.gov/articles/biden-harris-administration-invests-17-million-strengthen-nations-critical-minerals-supply

- W. Turner, British Opium Policy and its Results in China (London, 1876), s. 56.

- https://en.wikipedia.org/wiki/Locomotive_Acts

- https://eprints.lse.ac.uk/113000/1/Harvey_hidden_british_protectionism_published.pdf

- https://en.wikipedia.org/wiki/Bessemer_process

- https://en.wikipedia.org/wiki/Andrew_Carnegie

- https://de.wikipedia.org/wiki/Siemens-Martin-Verfahren

- https://www.money.pl/gospodarka/wiadomosci/artykul/swieto-pracy-1-maja-zawdzieczamy-amerykanskim

- https://en.wikipedia.org/wiki/William_McKinley

https://legacy.voteview.com/carnegie.htm - https://en.wikipedia.org/wiki/Standard_Oil

- https://en.wikipedia.org/wiki/J._P._Morgan

- Charles R. Morris, Giganci, Warszawa 2006

- https://cejsh.icm.edu.pl/cejsh/element/bwmeta1.element.desklight-ca6ece58-735c-4d05-bbde-7b3fed20a161/c/169-178-Zejmo-Istota.pdf

- https://en.wikipedia.org/wiki/Theodore_Roosevelt

- https://techcrunch.com/2024/02/21/hadrian-automations-ceo-wants-to-defy-history-and-revitalize-american-industry/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAANe9ns8ec6OWi8tkpJboOZADF9PTKnzkhbgwkdx1i95gbnNYrNulBQUqlTQQPmBA0vjlFGntx_FJuVwc55JlYXslmQpuio7ugbiSqxu6wLp4A